MEW Token: How WhiteBIT’s Listing and Bounty Program Drove Memecoin Green

Content

Solana-based cat in a dogs world (MEW) memecoin gets foot in the door amid market recovery. Discovering how the token rallied to become a weekly top gainer after WhiteBIT listing.

While memecoins have been widely popular for a long time, their showtime came recently – only in 2024. Long-standing Dogecoin (DOGE) or Pepe (PEPE) have been sharing investor interest with booming newcomers as dogwifhat (WIF) or Brett (BRETT).

Now a new player came into the spotlight. Cat in a dogs world (MEW), a Solana-based memecoin, surprisingly led the market sentiment and skyrocketed 130% at the last weekend of July, incenting major attention from the investors and institutions.

What drove MEW, and what defines its significance – below.

TL;DR

- Cat in a dogs world (MEW) has increased 130% on July 20-22 while its market capitalization indicated a 200% in just a few days.

- Reasons behind the price surge could be ETF-based interest in Solana and staggering token’s popularity in South Korea.

- MEW’s listing on WhiteBIT and the launch of the Bounty Program are considered the crucial factors of the token’s uptick. Just after the listing, MEW skyrocketed over 60% and reached its all-time high.

- On-chain metrics and market charts reveal strong bullish potential for MEW.

Korean Market Takeover Amid WhiteBIT Listing

MEW’s standout dynamics marked over 200% increase of its market capitalization. According to CoinMarketCap data, the token’s market cap increased from roughly $350M to $738M in a matter of 3 days, beginning its uptick on July 19. In the meantime, the price has secured 125% growth from July 20 to July 22.

A fair share of the memecoin’s showtime lied on Solana (SOL) as it has been gaining investors’ spotlight. Anticipations for Solana exchange-traded funds (ETFs) approval kept on heating, as the coin’s price indicated 60% throughout the last week of July.

Still, reasons behind MEW’s green strike transcended its originator’s success. The token has been gaining massive interest by the South Korean traders. Specifically, MEW has taken centre stage at the ROK-based Bithumb crypto exchange – one of the initial markets for the cat-inspired memecoin, tracing its listing back to April.

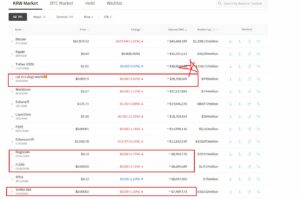

According to CoinGecko data, cat in a dogs world was a third-largest-trading asset on Bithumb, yielding only to Tether (USDT) and Bitcoin (BTC).

On July 22, MEW has even topped the list and was traded more that Bitcoin (BTC), Solana (SOL), Ripple (XRP), and other profound assets.

Source: juicehead.sui/X

The tendency was outlying for South Korean markets, as ROK exchanges have been prone to the conservatism in terms of the memecoins. Hence the memetoken’s volume has been mostly generated by the long-standing projects, i.e. Pepe (PEPE) and Dogecoin (DOGE).

MEW managed to break the wheel. According to South Korean investor Joshua, the cat-inspired memecoin has been doing as much volume as all major memes combined and leading the total volume in the South Korean won (KRW) pair pool.

KRW market outlook. Source: Joshua/X

Ultimately, MEW skyrocketed following a July 23 listing on WhiteBIT – one of the largest European crypto exchanges. According to the company’s post on X, the exchange introduced the MEW/USDT pair.

Source: WhiteBIT/X

The listing positively resonated with the community. Users heavily greeted the listing while top-tier media i.e. Cointelegraph reacted with the statements.

Apart from this, MEW has seen an immediate increase after the listing, reaching the all-time high (ATH) of $0.0096.

Source: X/WhiteBIT

MEW’s spike was also followed by the introduction of the WhiteBIT’s MEW Bounty Program – an array of tasks, for completion of which 250 winners will share the 6,000,000 MEW prize pool.

The list of winners is reported to be published on WhiteBIT Blog on August 26, 2024.

What is more, WhiteBIT introduced Crypto Lending for MEW at 1.5% for 30 days, which also added to the asset’s trading volume. Cryptopolitan has stressed out this initiative as a decisively positive factor for MEW that fosters the token’s holders. The asset is now becoming part of the passive income project, which is powered by blockchain capacities and decentralization.

WhiteBIT’s Crypto Lending is an instrument for passive income that allows one to make a profit by lending the assets according to one of the available plans. As per the MEW, its lending’s sustainability is ensured by the integration with Solana blockchain.