Bitcoin and Ethereum Options Expiry: How Will the Market Change?

Content

On the 24th of September, the Bitcoin and Ethereum options for $2,7 billion and $1,4 billion are expected to expire. As this date approaches, price fluctuations may occur in the market. Read on to find out what influences the process, what the MAX PAIN price is, why it should be taken into account, and what the behavior of market makers can be now.

How an option works: what is the benefit for the buyer/seller

An option contract is an agreement that gives you the right to buy or sell the underlying asset at a predetermined price. This derivative is more financially complex than futures. In this case, an agreement also involves two parties, where the first one is the buyer and the second one is the seller. The main attraction of options for Bitcoin, Ethereum, and other cryptocurrencies is the ability to earn from the future price of an asset without the obligation to buy or sell it at the time of the transaction.

The expiration dates are as follows: a week, a month, three months, or two years.

Options are divided into two types: a put option and a call option.

- The first one gives the option buyer the right to sell the underlying asset to the seller at the strike price.

- The second one gives the option buyer the right, but not the obligation, to buy the specified amount of the underlying asset at the strike price. The seller receives the right to sell the underlying asset if the buyer decides that they are ready to purchase it.

Thus, there are always four players in the options market:

- Those who buy call options.

- Those who sell call options.

- Those who buy put options.

- Those who sell put options.

The strike price is the price at which the option buyer can buy (for call options) or sell (for put options) the underlying asset according to the current option. The option seller can either sell or buy a specified amount.

Importance of volumes and prices of put and call options

The volume of options at a specific price can indirectly indicate in which direction the asset price will move, since big players are usually the ones behind large volumes. The ratio of puts and calls is also important.

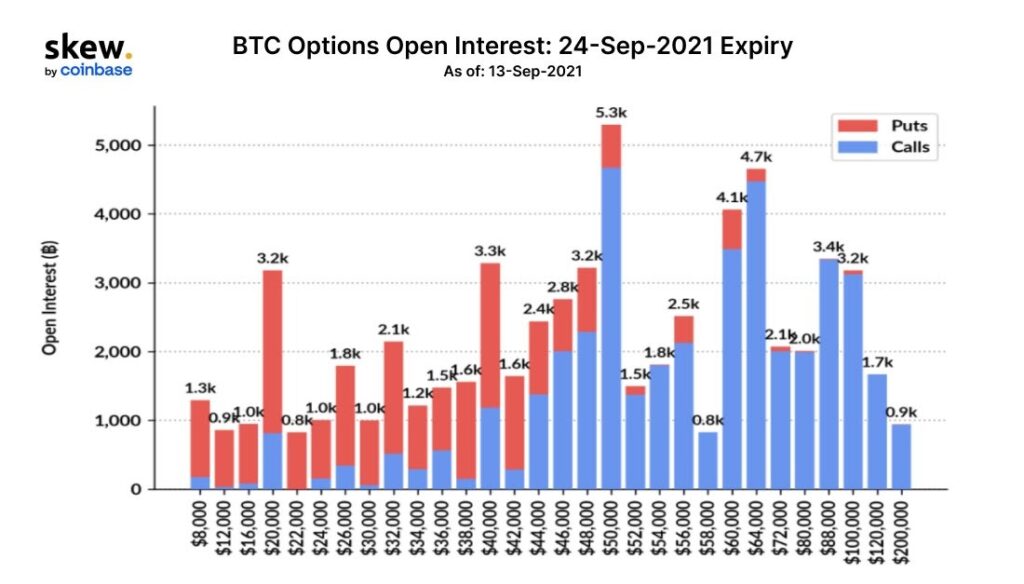

According to the statistics of the skew analytical resource, as we approach the expiration on the 24th of September, the open interest of Bitcoin options looks like this:

The open interest is concentrated around the call options:

- Call options open interest: 40,882,70.

- Put options open interest: 22,284.20.

On the chart, we can see the MAX PAIN price, where open options are theoretically depreciated. The Max Pain theory is based on the belief that investors will lose money if the price of an asset on the spot market moves in the direction opposing their interests by the time the options expire. Therefore, it is important to pay attention to the concentration points of large volumes.

According to the chart, the MAX PAIN price is at $44 thousand. The bulk of call options is accumulated at around $64 thousand. Also, the concentration of volumes is observed at $50 thousand, $88 thousand, and $60 thousand. It is important to understand that the peak values may shift as the expiration date approaches because the volumes of options change at each specific price.

The prevailing amount of put positions, on the contrary, is at a loss.

Market makers: why it is important to take into account their interests

As we have clarified, put and call positions can be “out of the money” (OTM), that is, become unprofitable. This happens if the market (spot) price of the underlying asset exceeds the strike prices of the sellers and buyers.

As the expiration date of the options approaches, market makers, that is, big players in the options market *, can [or will] push the prices of the spot market to lower or higher values.

Why:

- they need to close their deals profitably. According to the current situation, it is not profitable for them that call options close above the level of the max pay price;

- in order to maintain the liquidity of the asset in the market in the future.

Thus, if Bitcoin price continues to rise, market makers will be forced to hedge their OTM short call positions in order to maintain a lower asset value until the options expire.

Theoretically, trading volumes can increase or decrease, and volatility can increase or decrease (this is reflected in the dynamics of price fluctuations) shortly before the expiration date.

As for the situation today: according to IntoTheBlock, the average value of open interest on cryptocurrency exchanges ** for the last 7 days reached $12.64 billion; the fluctuations occurred between $11.95 billion and $13.21 billion. Since the 6th of September, volatility has risen from 35.54 % to 45.96%, the asset price (according to CoinMarketCap) in the same period fell from +-$51 thousand to +-$44 thousand per Bitcoin. In the last week, the price of Bitcoin did not rise above $48 thousand, and now it tends to gravitate toward $40+ thousand.

It is logical that following the expiration date of the options, the goal of market makers is also to remain in profit and/or to increase their savings in the asset. Accordingly, they will be able to sell/buy at low or high prices. Their actions will drive the subsequent trend: bearish (the cryptocurrency price will fall) or bullish (increase).

__________________________________________________________

* Big market players are whales, institutional investors, holders (addresses that have not moved an asset for more than a year).

** Data includes futures contracts.