What Is Crypto Algo Trading and How Does It Work?

Content

Crypto volatility can be both a source of huge profits and a cause of serious losses. Cryptocurrency algo-trading offers traders a solution to use the predictability of mathematical models where intuition and experience can fail. Let’s take a look at how it works.

What is Algorithmic Crypto Trading?

Algorithmic trading, or algo-trading, is the automation of the asset trading process using software algorithms that analyze market data and make trading decisions without human intervention. Сrypto trading algorithm considers parameters such as price, time, and volume and can execute strategies ranging from simple arbitrage trades to complex machine learning methods.

In simple words, in “traditional” trading, traders follow a certain order: they select an asset, determine the timeframe, analyze the chart and indicators, look for patterns, and calculate the volume of the position and the entry point. In other words, they act according to an algorithm. In algo trading crypto, similar actions are performed by a robot following a programmed algorithm.

How does Algorithmic Trading In Crypto Work?

Depending on the program’s tasks, bots can perform routine operations. For example, they can set Stop-Loss and Take-Profit levels by risk management when a trader opens positions manually. More advanced systems can trade in a “full cycle”—independently search for entry and exit points, set limits, consider indicators, and calculate position volumes.

Most often, the second option under algotrading is using full-fledged bots that work according to the strategy. Another similar term—“automated trading”—is associated with “algorithmic trading.”

In the stock exchange dictionary, the term “algotrading” can also mean the automatic splitting of a large order into several smaller ones to ensure a high speed of transaction execution. Such “splitting” is used by large participants and institutional investors to place orders at a weighted average price and avoid negative quote fluctuations due to large order volume.

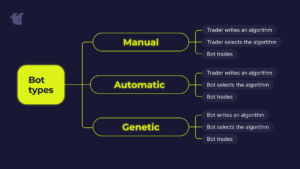

Types of Trading Bots for Algotrading

- Manual bot: When using such a bot, the trader analyzes the market independently and runs the corresponding algorithm. Usually, traders evaluate the market based on mathematical models, then choose a strategy and activate a robot that trades according to the chosen formula. For example, if a trader notices a pattern on the chart, he or she can launch a robot that “knows” how to trade effectively on that particular pattern.

- Automated bots contain several algorithms for different market situations. Algotrading strategies are put into the code at the programming stage. Then, having analyzed the market by indicators or patterns, the bot independently selects a set of rules and activates the necessary trading model.

- Robots with artificial intelligence, sometimes called genetic bots, choose suitable algorithms and create strategies. This is achieved by analyzing a large amount of historical data. This class of bots is the most advanced but also the most difficult to create and customize. Most of these robots are used in large investment funds, and their program code is a trade secret.

Сryptocurrency Algo Trading Strategies

Algo-bots use a variety of strategies to trade. Some focus on technical indicators such as price patterns or moving averages to profit from short-term trends. Others apply arbitrage strategies, capitalizing on price discrepancies between different exchanges. Here are some of the most popular Algo trading strategies used in the market:

- Trend trading. These algorithms focus on profiting from consistent uptrends or downtrends.

- Reversion to the mean. This strategy is based on prices’ tendency to return to their historical average. The algorithm buys assets when prices fall below a certain level and sells them when they reach a predetermined peak.

- Arbitrage Trading. The algorithm takes advantage of price differences on different cryptocurrency exchanges, buying on the one where the price is lower and selling on the exchange with a higher price, capturing a small difference in value.

- Scalping. These crypto trading algorithms aim to capitalize on the smallest price fluctuations by executing numerous small trades throughout the day. The effectiveness of this strategy directly depends on high market volatility.

Advantages & Disadvantages of Algo Trading

Algotrading automates trades according to predetermined strategies, ensuring speed and accuracy. However, along with its advantages, it also has its risks. It is essential to understand both the pros and cons of using this approach effectively in the market.

Pros of Algotrading:

- High speed and accuracy: Cryptocurrency algotrading allows you to make trades in fractions of a second, reacting to market changes faster than manually. This is especially important in volatile markets such as cryptocurrency.

- Process Automation: Crypto algorithmic trading eliminates the need for constant market monitoring. Once set up, the algorithm works autonomously, saving time and reducing the trader’s emotional burden.

- Risk optimization: Automated systems can include built-in risk management mechanisms such as automatic Stop-Loss and Take-Profit. This helps minimize losses and lock in profits within preset limits. In addition, minimizing slippage becomes a key factor in maintaining profits in high-frequency trades.

- Access to complex strategies: Algorithms can be programmed to execute complex trading strategies that would be difficult to implement manually. These include arbitrage, scalping, and other techniques that require fast processing of large amounts of data.

Cons of Algotrading

- High initial costs: Developing, customizing and testing effective trading algorithms requires significant financial and time investments. It also requires quality technical infrastructure, including high-speed access to markets.

- Risks of technical failures: Algorithms may encounter technical failures, errors in code or delays in data transmission, which may result in significant losses. Sudden changes in market conditions may render current algorithms ineffective.

- Need for constant monitoring: Although Bitcoin (BTC) algo trading automates many processes, it requires regular monitoring and adjustments. Markets change and algorithms may need to be updated or adapted to new conditions.

- Limited flexibility: Algorithms operate strictly within set instructions, which can be a problem in the face of sudden market changes or situations not accounted for in the program code. Human intuition and adaptability may be more effective in such cases.

What’s the Difference Between Algorithmic and Automatic Trading?

Algorithmic cryptocurrency trading, or algotrading, involves using complex mathematical and statistical models for the automated execution of trading operations. Algorithms are developed to execute specific crypto algorithmic trading strategies based on data analysis such as technical indicators, chart patterns, trading volumes and other market signals. Algo trading for crypto can involve complex strategies such as arbitrage, scalping, trend trading and mean reversion. When the algorithm detects suitable market conditions, these strategies are pre-programmed and executed automatically without human intervention.

Automated trading is a broader term that includes any trading done without human intervention using software. It can be simple automation of routine operations such as placing Stop-Loss or Take-Profit when positions are opened manually. Automated trading does not necessarily involve complex mathematical models or data analysis. Unlike algorithmic trading, automated trading can be set up to perform simple tasks such as copying trades or executing predetermined commands.

How To Start Cryptocurrency Algorithmic Trading?

- Start by learning the basics of algorithmic trading and deciding on a strategy (e.g., arbitrage, scalping, or trend trading). Understanding different strategies and their effectiveness in different environments is key to a successful start.

- Identify a platform that supports algo crypto trading and select the tools to implement your strategy. If you have programming skills, you can create your own bot; if not, use off-the-shelf solutions that allow you to customize bots without code.

- Conduct back testing (testing on historical data) to evaluate the effectiveness of your chosen strategy. After successful testing, run the bot on the real market. Start with small amounts and closely monitor the bot’s performance, especially in the initial stages, to make timely adjustments.

- Monitor the bot’s performance, update algorithms as market conditions change, and optimize your strategy. Risk management mechanisms such as stop-loss and volume limits should be used to minimize potential losses.

Key Crypto Algo Trading Strategies

Algotrading in cryptocurrencies uses several strategies to automate trades and manage risk. Let’s take a look at the key ones.

Arbitrage Trading

Arbitrage trading is based on exploiting differences in the price of the same asset on different exchanges or markets. Algorithms quickly detect these differences and execute trades for profit, buying an asset on one platform and immediately selling it on another with a higher price. This strategy requires high execution speed and minimal latency.

Market Making

Market making is a strategy in which algorithms simultaneously place orders to buy and sell the same asset to capitalize on the spread between the buy and sell prices. Algorithms seek to maintain market liquidity and capitalize on small but frequent price fluctuations. It is important to consider market conditions to avoid losses due to sudden price movements.

Trend-Following

Trend-following involves having the algorithm identify consistent uptrends or downtrends and make trades in that direction. The strategy assumes that the current trend will continue and allows you to profit from market movements over a long period.

Mean Reversion

The mean reversion strategy assumes that the price of an asset tends to return to its mean after deviations. Algorithms buy an asset when its price falls below its historical average and sell when it rises above that level. This strategy works well in markets with low volatility and well-defined ranges.

Final Thoughts

Cryptocurrency algo-trading opens up new opportunities for traders to optimize trading strategies and minimize risks. Success in this direction requires not only the implementation of algorithms but also constant work on strategies that consider all the peculiarities of the cryptocurrency market. In a cryptocurrency market where FUD can trigger mass pani, and FOMO can trigger rash decisions, algorithmic trading helps reduce the influence of emotions and make more rational decisions.

FAQ

Algotrading improves trading efficiency by automating processes and minimizing risks.

Yes, cryptocurrency alt-trading is legal, but it requires compliance with local laws.

Algorithmic trading can be profitable, but its success depends on the quality of strategies, algorithm customization, and market conditions.