What is Dollar Cost Averaging Strategy in Crypto?

Content

Everyone comes to the cryptocurrency market with a desire to make money. Learning the ins and outs of trading and investment strategies becomes challenging with time constraints. What do you do for those who need more time to analyze the market constantly and are looking for a way to invest effectively without unnecessary stress? The DCA strategy comes to the rescue.

DCA Crypto Meaning

Dollar Cost Averaging (DCA) is a strategy of regularly purchasing an asset in equal amounts regardless of price. For example, buying $1000 worth of cryptocurrency monthly or weekly. This method of investing averages the value of the purchased cryptocurrency, saving investors time and nerves, as they do not need to constantly monitor the market and be aware of all events.

How Does Dollar Cost Averaging Work

Approximately 23 thousand different cryptocurrencies are currently in circulation. The first thing to do is to choose from this number an asset that will increase in value and bring income in the future. Not all cryptocurrencies are suitable for investment. It is better to focus on crypto with large market cap, such as Bitcoin and Ethereum, as they are more stable. The investor then determines the amount and regularity of investment and exit points to lock in profits. Now, let’s look at how DCA works in practice.

Bitcoin DCA Strategy Example

Let’s say you have $1000 to invest. Of course, you can buy crypto for the entire amount at once, but there is a pitfall — volatility. Predicting the perfect entry point in a volatile exchange rate is impossible. What does the DCA strategy offer? It suggests dividing the sum of $1000 into several parts and investing them in equal portions at regular intervals.

Let’s imagine that we invested in Bitcoin from January 1, 2023, to January 2024:

| Month | Price of Bitcoin | Investment Amount | BTC |

| January 2023 | $16 619 | $100 | 0.00601 BTC |

| February 2023 | $23 725 | $100 | 0.00421 BTC |

| March 2023 | $23 646 | $100 | 0.00422 BTC |

| April 2023 | $28 466 | $100 | 0.00351 BTC |

| May 2023 | $27 984 | $100 | 0.00357 BTC |

| June 2023 | $26 815 | $100 | 0.00372 BTC |

| July 2023 | $30 596 | $100 | 0.00326 BTC |

| August 2023 | $29 195 | $100 | 0.00342 BTC |

| September 2023 | $25 798 | $100 | 0.00387 BTC |

| October 2023 | $27 929 | $100 | 0.00358 BTC |

| November 2023 | $35 439 | $100 | 0.00282 BTC |

| December 2023 | $38 750 | $100 | 0.00258 BTC |

| January 2024 | $43 835 | $100 | 0.00228 BTC |

As you can see, the price of BTC/USDT went up and down during this period. Thanks to the DCA strategy, it was possible to accumulate 0.04705 BTC. The average purchase price is calculated by dividing the total amount invested by the total number of Bitcoins purchased, resulting in an average cost per Bitcoin of $27,630.

At the time of writing, the price of Bitcoin is $72,207. If we lock in a profit at the current price (0.04705 × 72,207), we get $3,397 or $2,097 net profit (less the $1,300 invested).

But we could have invested $1,300 in January and bought Bitcoin at $16,619! Absolutely. However, what would have happened if the price had gone even lower? You can spread out your investment instead of risking the entire amount simultaneously. This reduces the impact of volatility and the risk of loss associated with entering the market at the wrong time. As a result, by buying cryptocurrency gradually, you can achieve a more stable average buying rate.

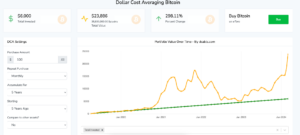

BTC DCA Calculator: Real Case

The dollar cost averaging calculator is a handy tool for calculating the effect of dollar cost averaging. You need to enter the amount of investment, the length of the period, and the frequency of contributions. The screenshot shows a graph of monthly investments in Bitcoin at $100 for five years.

Source: dcabtc.com

In this case, investing using the DCA BTC strategy at a $6000 investment can lock in a profit of $23,886 (+298%).

How to Track Your Portfolio?

Putting together a crypto portfolio allocation can be done in several ways:

- Investment Journal. You can make a spreadsheet and record your investments and sales regularly. Dollar cost averaging example:

| Date | Price of Bitcoin | Investment Amount | BTC |

| 01.12.23 | 38 750 | $100 | 0,00258 |

| 01.01.24 | 43 835 | $100 | 0,00228 |

| 01.02.24 | 42 908 | $100 | 0,00233 |

| 01.03.24 | 62 461 | $100 | 0,00160 |

- Specialized applications and platforms. Many apps and web platforms are designed specifically for monitoring cryptocurrency portfolios. They allow you to easily track current cryptocurrency prices, historical data, percentage changes, etc.

What is a DCA bot?

A DCA bot is an automated software solution that trades on the cryptocurrency market according to predefined algorithms and strategies.

GoodCrypto’s DCA trading bot helps maximize profits and minimize investing risks thanks to the averaging strategy. It allows you to gradually accumulate positions by automating the buying and selling of digital assets. The bot offers manual and automatic modes of operation, with the automatic mode using data from 25 technical indicators to determine optimal entry and exit points.

Dollar Cost Averaging vs. Lump Sum Investing

Lump sum vs DCA are two different strategies. Each represents different approaches to investing in cryptocurrencies that affect an investor’s PNL. A lump sum involves investing the entire amount in a lump sum. This can lead to quick profits but also exposes the investor to the risk of buying at a high price if the price rises.

The DCA strategy, on the other hand, suggests splitting the investment into equal parts and buying cryptocurrency regularly. This helps reduce the impact of short-term volatility and averages out the position. This approach allows the investor to reduce emotional reactions to price changes and reduce the risk of buying at an inflated price, but it may result in the loss of possible profits in case of a sharp rise.

Dollar Cost Averaging Pros and Cons

Advantages

Benefits of dollar cost averaging include:

- Reduced risk while entering the market: DCA allows you to invest a certain amount gradually and over some time in the cryptocurrency market. This helps reduce the impact of short-term market volatility and the risk of buying an asset at an inflated price.

- Efficient utilization of funds: An investor can plan his financial flows by regularly allocating a certain amount for DCA investment. This allows the funds to be used more efficiently than buying large amounts of cryptocurrency at one time.

- Minimizing emotional reactions: Since investments are made regularly and are not dependent on the asset’s current price, DCA in trading helps reduce the investor’s emotional responses to short-term changes in the market situation.

Disadvantages

The only significant disadvantage of the DCA strategy is the loss of possible profits. In a sharp market rise, an investor using a DCA strategy may miss the opportunity to capitalize on positive price movements because their investment was spread evenly over time.

Conclusion: Is Dollar Cost Averaging A Good Idea

DCA in crypto is an easy way to start investing. Learning and applying a dollar-cost averaging strategy in cryptocurrency investing is crucial to reducing risk and managing market volatility. DCA meaning in crypto to enter the market gradually, avoiding the need to try to predict the optimal time to buy assets. However, before deciding to employ this strategy, you should carefully review the available information, make calculations, and analyze your investment objectives and risk tolerance.