What is Profit and Loss (PNL), and How to Calculate It?

Content

Main:

- PNL, also known as Profit and Loss, is a crucial financial metric that helps determine the profitability of investments or trading activity by calculating the difference between expenses and earnings.

- Realized PNL (rPNL)reflects the profits or losses for a closed trading position and is indicated by a number. If the position was fully closed, rPNL reflects the final result of the trade, and if partially closed, it reflects the profits or losses for the portion of the closed position.

- Unrealized PNL (uPNL) reflects the profits or losses for an open trading position and is expressed in a digital equivalent and as a percentage.

- PNL is calculated using the formula: PNL = (Exit Price x Amount Sold) – (Entry Price x Amount Bought) – Fees.

- Overall, PNL is an important risk management tool that helps make decisions based on objective data.

What is Profit and Loss (PNL), and How to Calculate It?

PNL, or Profit and Loss, is a financial metric that determines the profits or losses of various industries and investment activities. This calculation accurately measures the money gained or lost due to a specific operation, making it a valuable indicator for evaluating different strategies’ effectiveness.

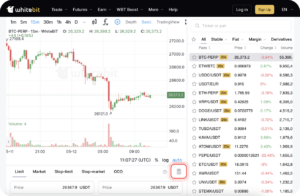

On WhiteBIT, PNL can be calculated for futures and margintrading in the zone where trading orders are placed.

If you need to become more familiar with these terms, read in-depth articles on types of orders, futures, and margin trading on the WhiteBIT Blog.

Below you will learn what PNL is, what features each type has, and how this indicator is calculated on WhiteBIT.

Realized PNL and Unrealized PNL: What is the Difference?

What is Realized Profit and Loss (P&L)?

Realized Profit and Loss (P&L), or rPNL, refers to the profits or losses earned after closing a position. If the position was closed completely, rPNL reflects the final trading result. When a position is only partially closed, rPNL displays the profits or losses for the closed portion.

rPNL is a valuable tool for tracking investments’ effectiveness and evaluating trading strategies’ performance. It is also essential for reporting purposes, as it determines a person’s tax liability. On WhiteBIT, rPNL can be found in the “Positions History” section.

It’s important to note that on WhiteBIT, rPNL is displayed as a number only, without percentages, for a closed position, as its size can change over time. Additionally, rPNL is calculated as a single indicator for one position for a specific trading pair. This position is formed from all executed trading orders until closed completely.

Understanding RPNL and Averaging Positions in Trading

It is a strategy where a user adds additional positions to an already open position but at more favorable prices, reducing the average price. If the average market price after averaging is advantageous, then part of the uPNL can be profitably closed.

Suppose a trader purchases 1 BTC for $50 000, but the market value drops to $40 000, resulting in a $10 000 loss. Instead of closing the position and accepting the loss, the trader averages it by buying an additional 1 BTC at $40 000. As a result, the average price becomes (1 * $50 000 + 1 * $40 000) / 2 = $45 000.

If the price of BTC increases again to $50,000, the position will become profitable because the average market price is lower than the current price. This means that some of the uPNL can be realized as rPNL by closing a portion of the position.

If the trader decides to sell half of their position (i.e., 0.5 BTC) at the current market price of $50 000, his rPNL will be (0.5 * $50 000 – 0.5 * $45 000) = $2500. In this scenario, averaging the position was profitable because the BTC price rebounded to its initial level, and the average price was lower than the current price.

What is Unrealized Profit and Loss (P&L)?

Unrealized Profit and Loss (P&L) is a metric that helps keep track of potential profits or losses from an open position.

WhiteBIT displays uPNL as a number and percentage for the current position volume. It provides traders with valuable information about assets, and helps to make informed decisions about when to close or adjust trading positions. It is also an essential tool for risk management, as it allows the control of potential losses.

Furthermore, it is essential to note that uPNL only directly impacts your balance once the position is closed or averaged. However, if the losses are significant enough and there are not enough funds in the “Collateral Balance,” the position may be liquidated. As such, sticking to your trading strategy and risk management is crucial to avoid such scenarios. Additionally, it is essential to remember that profit is only realized once it is closed, and the same applies to losses.

How is PNL calculated?

The Profit and Loss (PNL) calculation varies depending on the industry, investment or trading activity, and asset class. These indicators can be expressed in different formats, such as:

- In percentages. For example, if you invested $10 000 in BTC and earned $1 000 in profit, the realized PNL would be 10%.

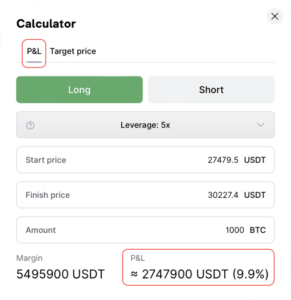

- In currency. For example, if you bought 1 BTC for $30 000 and sold it for $35 000, the PNL would be $5000. Notably, the WhiteBIT calculator displays PNL in Tether (USDT) and percentages for instant and easy access.

PNL is calculated using a formula similar to traditional financial markets:

PNL = (Exit Price × Number of Sold Units) – (Entry Price × Number of Bought Units) – Fees.

For example, if a user sold 1 BTC for $50,000 and bought it for $40 000, and paid a $100 fee, the PNL can be calculated using the formula:

($50 000 × 1 BTC) – ($40 000 × 1 BTC) – $100 = $9 900

Therefore, the PNL is $9 900. The WhiteBIT calculator can also help calculate PNL based on the trading position, asset price, and amount. In addition, it is necessary to consider the current commission for the transaction. However, it can be lowered if you have WBT in Holding or Owning or VIP client status.

It’s important to note that the fee for a particular trading position is determined according to the WhiteBIT Terms.

- For margin trading, the fee is charged for using borrowed funds. This is a fixed rate of 0.0585% per day.

- For futures trading, the fee is dynamic and is charged every 8 hours for open positions, and it depends on the funding rate, position, and current market conditions. A countdown to the subsequent funding is displayed on the trading page.

In conclusion, PNL is a helpful tool that helps calculate a position’s potential and actual profit or loss and make informed decisions. It can reduce risks and increase profits. Therefore, if you plan to trade on the WhiteBIT exchange, we strongly recommend learning how PNL works and paying attention to it.

FAQ

PNL, or Profit and Loss, is a financial metric that shows profit or loss by measuring the difference between earnings and expenses.

Yes, PNL, P&L, and P/L are the same terms and refer to the same financial metric.

P&L is an essential tool that helps to make data-driven decisions. It accurately measures the funds earned or lost due to a specific operation, making it a valuable indicator for evaluating different strategies' effectiveness.

Yes, the fee is assessed when calculating PnL. The formula for calculating PnL is PNL = (Exit Price x Amount Sold) - (Entry Price x Amount Bought) - Fees.

Remember that the P&L calculator on WhiteBIT does not consider fees or funding when showing your approximate P&L. So, use it for the general trading strategy evaluation rather than for accurate calculations.