Synthetic assets: new opportunities and higher incomes on DeFi

Content

Crypto enthusiasts, blockchain project creators, and even representatives of large funds believe in the decentralized finance market. Industry professionals pay special attention to synthetic assets. And for a good reason. In today’s article, we invite you to dive into the topic of crypto-synthetic assets in the DeFi market and find out why this direction is most relevant both for business and for participants in the crypto industry.

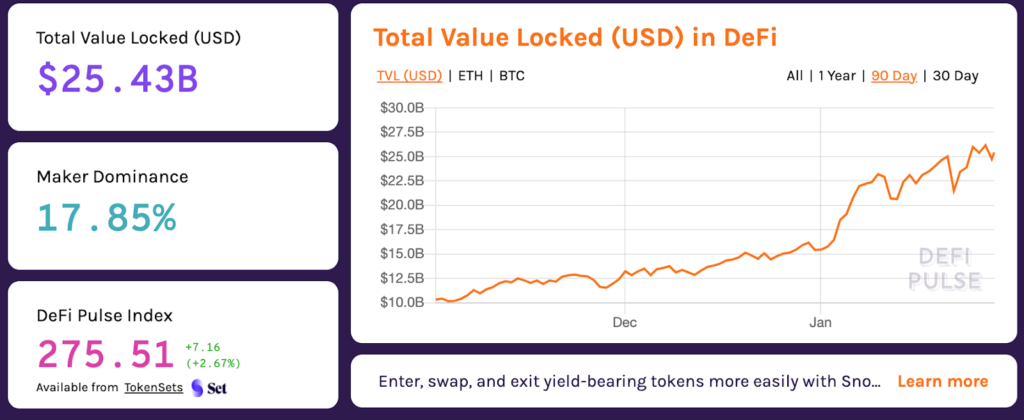

Over the past year and a half, the DeFi market has significantly strengthened its position, scaling its capabilities and community. The amount of blocked funds has already reached almost $ 25.5 billion, and this is far from the limit.

The amount of blocked funds in the DeFi market

Thus, instruments from the world of decentralized finance are constantly improving, and recently it is synthetic assets that are gaining popularity due to their potential.

What are synthetic assets?

Now we see a tendency for certain elements of the financial system to move to the crypto-economic space. According to experts’ forecasts, soon, the entire financial world will not only be digitized but will also work on the basis of blockchain technologies. It should be borne in mind that most people use fiat currencies because of their doubts about cryptocurrencies’ volatility. This reason became the starting point for the creation of crypto-synthetic assets.

Synthetic assets are a combination of assets that have the same value. With the help of synthetics, derivative instruments (options, swaps, or futures) are collaborated to imitate the underlying asset, which can be gold, silver, real estate, or any other property.

Describing the synths’ essence, we can say that with the help of them, users are able to track the value of any real assets while remaining part of the cryptocurrency environment.

Scope of application

About 1 billion people around the world don’t have access to banking services. And it’s DeFi that solves this problem by giving everyone equal financial opportunities. And all people need is any gadget with an Internet connection.

Let’s look into the near future and imagine a scenario for buying real estate using synthetic assets. If you don’t have enough money and time to complete all the paperwork, DeFi and crypto-synthetic assets will come in handy for you. You can buy a fractional part of a house or an apartment in an apartment building for fiat currency without actually owning the entire property. The synthetic token will track the value of the real estate, and when the price of an object rises, the value of the token will also rise.

Thus, we get an excellent investment model that can be chosen for the long term. Anyone can easily become an investor and engage in both crypto and traditional assets trading.

Cryptocurrency synthetic assets help industry participants gain access to virtually all of the world’s assets, which is an excellent way to make money.

Of course, the architecture of decentralized finance (DeFi) guarantees more stability and transparency than conventional banks.

Let’s highlight the main advantages of synths. Firstly, they reduce the risks that can be associated with traditional assets. Secondly, synthetic assets are not subject to sharp price changes due to financial derivatives. They also contribute to higher profits.