How to withdraw crypto to bank account?

Content

- Ways to withdraw cryptocurrency to a card from your wallet

- How to withdraw cryptocurrency from the WhiteBIT exchange: guide

- Sell Crypto

- Withdrawal of cryptocurrency to the card using an exchanger

- P2P exchange services

- How to withdraw cryptocurrency via P2P Express: guide

- Using an e-wallet to withdraw cryptocurrencies

- How to cash out crypto through crypto ATMs

- Features of cards with the possibility of direct withdrawal of cryptocurrencies

- FAQ

Many beginners wonder how to withdraw cryptocurrency to a bank account and if it is easy to do. Everything is pretty simpler than it might seem at first, because there are many ways to withdraw cryptocurrency to a bank account. You can use cryptocurrency exchanges, crypto exchanges, P2P services, crypto wallets and even crypto ATMs.

All these methods have different advantages and disadvantages. One of the most common problems when replenishing and withdrawing crypto to bank accounts are high commissions, complexity of operations, inconvenient interfaces and a generally low level of trust in the intermediaries of such operations.

Centralized cryptocurrency exchanges and P2P platforms are the most convenient, safe, and generally popular options. Such services win over competitors because of the ease of converting cryptocurrencies into fiat money, as well as lower commissions.

Why? Let’s take a look at how to manage crypto withdrawal with the help of various services.

Ways to withdraw cryptocurrency to a card from your wallet

Users worldwide can withdraw crypto to a bank account using the following options:

- Crypto exchanges;

- Crypto exchangers;

- Peer-to-Peer exchange services;

- E-wallet;

- Crypto ATMs.

Each method has its own pros and cons. Some of them are quite unsafe, some — quite expensive. We’ll highlight each of them.

Cryptocurrency exchanges with card withdrawal

Cryptocurrency exchanges with withdrawal to the card

Most cryptocurrency exchanges provide users with the solution of how to cash out cryptocurrency. If we talk about centralized exchanges, before withdrawing, they require users to pass KYC (know your customer) procedure to comply with the rules set by the regulator. The procedure only means that you need to confirm your identity.

In addition, due to strict legislation, withdrawals from crypto exchanges may be restricted in some regions. Therefore, you must first study restricted access zones before withdrawing cryptocurrency from a crypto exchange. Most likely, such platforms will inform you about registration restrictions.

However, centralized crypto exchanges are often considered the best option of how to withdraw from crypto to bank account, as they offer a high level of liquidity and security, as well as ease of use.

Liquidity

Centralized exchanges usually have a large pool of buyers and sellers, which means a higher probability of finding a buyer or seller for a particular cryptocurrency. This simplifies and speeds up the withdrawal of money from the exchange.

State currencies

Centralized exchanges usually support state currency withdrawals, which means users can withdraw cryptocurrency as cash to their bank accounts. It is a convenient way for users to access their funds and use them for everyday expenses.

Convenient interface

Centralized exchanges often have a more user-friendly interface than any other services. This makes it easier for users to navigate the platform and withdraw funds. Even a beginner will intuitively figure out how to withdraw money from cryptocurrency to a card and how to trade on the crypto exchange in general.

Security

Centralized exchanges typically have robust security measures in place, including two-factor authentication, encryption, and cold storage. This reduces the chance that the user’s funds will be lost or stolen during the withdrawal process.

Compliance

Centralized exchanges are regulated, which means they must follow certain rules and procedures to prevent fraud and money laundering. This provides users with an extra level of security and ensures that their assets are held responsibly.

How to withdraw cryptocurrency from the WhiteBIT exchange: guide

If you consider exchanges as the best way for withdrawing cryptocurrency, let’s take a closer look at this option with WhiteBIT exchange as an example.

Preparation

To withdraw your funds, you must first sign up and verify your identity. This is a fairly simple procedure, and you can complete it in 10 minutes.

To verify your identity, follow these steps:

- Go to the “Verification” tab in the account menu;

- Enter the data specified in the form;

- Enter your residential address;

- Upload a photo of your passport, ID card, or driver’s license;

- Follow the further instructions.

Also, to secure your account, be sure to enable two-factor authentication.

You can complete it in the “Security” tab of your account menu.

To get started, download a key generation program like Google Authenticator;

Scan the QR code indicated on the “Security” page in the “Two-factor authentication” section;

Confirm the settings.

Now your account is more secure and withdrawing money to the card is safer.

Sell Crypto

After you have successfully registered, verified your identity, enabled two-factor authentication, you can start withdrawing cryptocurrency. You can withdraw to the card only national currencies, for example, euros or dollars. Therefore, if you have Bitcoin or other cryptocurrency to withdraw it to the card, you need to follow a small procedure of converting cryptocurrency to national currency with two simple steps.

Step 1. Sell cryptocurrency

First, you need to sell cryptocurrency. Follow these instructions:

- Go to the “Spot trading” page;

- Find a trading pair of your cryptocurrency with a national currency, such as USD or EUR;

- Sell your cryptocurrency.

Step 2. Exchange cryptocurrency

Buy cryptocurrency with national currency or exchange one digital asset for another in seconds. How can you do that? Let’s do it together, step by step:

- Sign up for the WhiteBIT exchange and confirm your identity, or log in to your account if you have already verified it;

- In the “Trade” section, open the “Convert” page;

- Select the asset you want to “Give” and the asset you want to “Receive.” Exchange any assets for any others. This function can be used at the current rate at the time of exchange with no hidden fees;

- Specify the necessary asset amount. The sum you’ll get and the one you’ll give will be displayed in USDT equivalent for convenience. The system fixes the rate every 10 seconds, after which you need to update the offer by clicking the button. You will see the current rate. Click on the “Continue” button to complete the transaction;

- If you don’t have enough assets for the exchange, click the “Deposit” button and top up your balance. After that, return to the “Convert” page and continue;

- After the exchange, you can go to the assets you exchanged by clicking the “Go to balance” button. Check the info about previous transactions in the “History” — “Convert” section.

Trade with the assets you want!

Balances

To complete the crypto withdrawal, go to the “Balances” menu. You have three types of balances (Main, Trade and Collateral). The “Total” tab shows the total number of assets on all three balance sheets. To withdraw cryptocurrency, you need to transfer the required amount to the Main Balance.

To do this, select the “Transfer” option opposite your currency on the Trade balance. In the pop-up window, select the amount you want to withdraw and transfer it to the Main Balance. Now you are ready to withdraw funds.

Finish

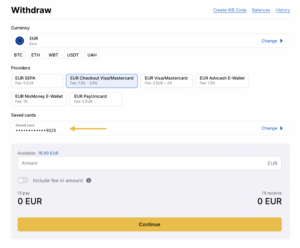

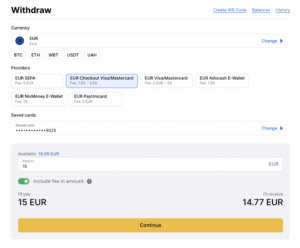

On the Main Balance page, next to your national currency, select the “Withdraw” option. In the pop-up window, select the payment system through which the transaction will be made. Visa/Mastercard, GEO Pay and other options are available. There are 10 national currencies available and 15 withdrawal methods available on our exchange — you will definitely find the one suiting you.

If you choose the first option, the money will be credited to the specified card. If you choose GEO Pay, you will need to additionally specify your card details on the GEO Pay website.

After this, the algorithm is very simple:

- Enter card data;

- Enter the amount you want to withdraw;

- Confirm the withdrawal request.

Done!

UAH withdrawals to Vіsa/Mastercard or GEO Pay are not available at the moment. To withdraw UAH, use P2P Express instead. Find the tutorial on how to do that below. Learn fees for withdrawing fiat currencies through different payment systems on our fees page.

Withdrawal of cryptocurrency to the card using an exchanger

Unlike cryptocurrency exchanges, like WhiteBIT, crypto exchangers serve only as a medium for cashing out crypto to fiat and vice versa. So, usually, you cannot exchange crypto for other crypto using these platforms. That is why crypto exchangers charge higher fees than exchanges.

As of pluses, if you don’t know how to cash out Bitcoins, for instance, you can use crypto exchangers. They operate both with transactions to the bank account and cash withdrawals. For the latter, a user needs to attend the office of such a company and get cash in person.

Crypto exchangers vary, but mostly they don’t have as many requirements to a crypto withdraw process like KYC. Very often exchangers ask for your contacts like phone number and e-mail just to contact you. Highly unlikely that they will ask you to verify your identity.

Also, such platforms are very low in terms of safety, so you need to be extra careful when using crypto exchangers. It poses a certain danger of losing money because the only safety measure here is your trust.

P2P exchange services

Peer-to-Peer exchange services are also an option when you seek how to withdraw crypto to a bank account. Using these services, you post an ad with your price of purchase or sale included. You can buy or sell both crypto and fiat. If any other user of a P2P exchange agrees to accept your offer, you have a deal!

P2P platforms allow users to buy, sell and exchange digital assets.

One of the main advantages of P2P platforms is that they offer users more control over their digital assets. Unlike centralized exchanges, where users must deposit their funds, P2P platforms allow users to control their own private keys and operations from crypto wallet to bank account.

Another advantage of P2P services is that they usually offer lower crypto withdrawal fees than centralized exchanges because there are no intermediaries involved in the transaction process. In addition, P2P platforms often provide a variety of payment options, allowing users to buy and sell cryptocurrencies using a variety of payment methods, such as bank transfers, credit cards, and e-wallets.

P2P exchanges are the cheapest way to withdraw crypto to fiat. Also, P2P exchanges often use escrow accounts that enhance the safety level of such platforms. The funds are only released when P2P exchange receives money from both parts of the deal.

Overall, P2P platforms provide users with a more decentralized and transparent way to buy, sell, and trade cryptocurrencies. By eliminating intermediaries and allowing direct peer-to-peer transactions, these platforms provide users with greater security, control, and privacy.

How to withdraw cryptocurrency via P2P Express: guide

Now, you can withdraw your cryptocurrency via P2P Express service to the bank card. This service is available only to Ukrainian users who passed the KYC procedure. The only cryptocurrency you can sell is USDT, and the withdrawal will be made in UAH to a bank card in the scope of one transaction.

- Go to the “Balances” page and press “P2P Express” in the USDT field in the assets list.

- On the open page, enter the USDT amount you want to see and the bank card details. In the field below, you will see the amount of UAH you will receive. Mark the checkbox that you agree that your transaction will be performed outside WhiteBIT via the third-party Service Provider. You are acquainted with and fully accept the Service Provider’s Terms and Conditions. Then, press Continue.

- Confirm the transaction. If you have it connected, you will receive a confirmation code in your inbox and the 2FA app.

- An order for selling USDT will be placed. Note that it can take some time. Wait until the transaction is completed and the UAH is sent to your card.

Using an e-wallet to withdraw cryptocurrencies

E-wallets are not the most popular way of how to cash out crypto. However, they are quite useful for such operations. Most of the e-wallets require users to sign up before using its services. After it, you can easily convert crypto to national currencies or the other way around. It takes just several clicks when you pick the crypto from your account and exchange it for cash.

E-wallets often charge higher fees than crypto exchanges and P2P platforms, but not that high as crypto exchangers. If you often use e-wallets, it’s a good option to convert Bitcoin to cash.

How to cash out crypto through crypto ATMs

Crypto ATM is a very quick option of how to withdraw money from crypto. It is quite easy: you just need to scan the QR code and transfer crypto to this address. Then, receive cash or a bank transfer. For the latter, you need to insert your debit or credit card.

The main disadvantage of crypto ATMs, if you want to withdraw Bitcoin to a bank account, is the significant fee. Crypto ATMs charge really a lot of money for its operations, so you can consider other ways of withdrawing crypto.

Special cryptocurrency plastic cards

Special cryptocurrency plastic cards are debit or credit cards that allow you to use cryptocurrencies in the same way as state currency. These cards work by instantly converting your cryptocurrencies to the state currency of your choice at the point of sale.

Features of cards with the possibility of direct withdrawal of cryptocurrencies

Cards that allow for direct withdrawal of cryptocurrencies typically have the following features:

- Crypto range. It allows withdrawing plenty of cryptocurrencies, like Bitcoin, Ethereum;

- Instant Conversion. The card converts cryptocurrencies to a national currency instantly;

- Regular card advantages. The card may be offered as a debit card, which can be used to withdraw cash at ATMs or make purchases, or a credit card, which can be used to make purchases and earn rewards;

- Mobile App. The card may come with a mobile app that allows you to view balances, transaction history, and manage the card;

- Security. The card provides security features to protect against fraud and suspicious transactions.

Is it legal to withdraw cryptocurrency to a card?

The legality of withdrawing cryptocurrency to a card varies by country and jurisdiction. In many countries, withdrawing cryptocurrency to a card is legal and regulated, while in others it may be restricted or outright banned.

It is important to research and understand the laws and regulations in your country before withdrawing cryptocurrency to a card. Some countries may require additional steps, such as obtaining licenses or registering with financial regulators, to legally withdraw cryptocurrency.

Additionally, some exchanges or services may have restrictions on the countries or regions where they offer card withdrawals. Always research and compare multiple options before choosing an exchange or service to ensure it is available and meets your needs.

Advantages of selling cryptocurrency for national currency with withdrawal to a card

Selling cryptocurrency for national currency with withdrawal to a card has several advantages, including:

- Ease. Withdrawing to a card allows you to access your funds quickly and easily, without the need to transfer to a bank account first;

- Speed. Card withdrawals are mostly faster than bank transfers, so you can get your money within several minutes to several hours;

- No Bank Transfer Fees. Withdrawing to a card often eliminates the need for a separate bank transfer, which can save on fees;

- Wide Acceptance. Cards are widely accepted for purchases and withdrawals, making it easier to use your funds.

FAQ

Is withdrawing crypto taxable? Whether you have to pay taxes when cashing out cryptocurrency depends on your country's tax laws and the specifics of your financial situation. In many countries, cryptocurrencies are considered taxable assets, and the sale of cryptocurrencies may trigger a tax liability.

It is important to research and understand the tax laws in your country and consult with a tax professional if necessary. Also keep accurate records of all cryptocurrency transactions, including purchases, sales, and exchanges, to ensure compliance with tax laws and avoid potential penalties.

There could be several reasons why your crypto withdrawal is pending, including:

You can use the following options to cash out your crypto:

- Crypto exchanges;

- Crypto exchangers;

- Peer-to-Peer exchange services;

- E-wallet;

- Crypto ATMs.

It’s you to decide when to cash out crypto and what option to choose, but experts believe that crypto exchanges and P2P-services are the best picks.

Crypto withdrawal varies from place to place, so it depends on what you look for. Cryptocurrency exchanges, P2P exchange services are among the most convenient options for withdrawing crypto to bank accounts with low fees.

Before withdrawing on the card, bitcoin must be exchanged for the national currency. The most convenient way to do this is on a cryptocurrency exchange or a P2P service.

To cash out bitcoin, for example, on the WhiteBIT cryptocurrency exchange, you need to:

- Sell Bitcoin on the spot market for national currency, such as the US dollars.

- Or exchange Bitcoin for dollars or other state currency in the “Quick Exchange” tab.

- The currency of your choice will appear in the “Assets” section.

- After that, you can choose a convenient way to withdraw funds to the card.

Depending on the method, the money will be credited to your account in a matter of minutes to several hours.

Also, WhiteBIT mobile application is simply the easiest crypto app to withdraw money to your bank account.