What is WhiteBIT Earn?

Content

Recently, another helpful tool appeared on WhiteBIT — WhiteBIT Earn. It includes an updated Crypto Lending (formerly SMART staking). Crypto Lending is already available for all users of the platform. This article will describe how it works and its advantages and disadvantages.

WhiteBIT Earn is one of the critical products of the WhiteBIT ecosystem. This single system provides an opportunity to receive passive income from long-term investments in digital assets. It consists of Crypto Lending and Staking.

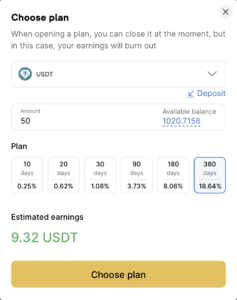

The user receives a reward by investing digital currency in Crypto Lending. The percentage depends on the holding period and the asset. As a rule, you can get from 0,23% to 18,64%.

Crypto Lending is a modern alternative to the classic bank deposit, only in digital assets, with higher interest rates. You give the asset to WhiteBIT for storage, and we return it to you after a specific time with interest. The whole process happens automatically on one platform.

According to the data for 2022, the average yield on bank deposits in dollars (USD) is from 0.01% to 3%. It is impossible to deposit in USD on WhiteBIT, but you can use a Tether (USDT) plan, a stablecoin with a fixed or stable rate. USDT is pegged to the dollar price: 1 USDT equals $1 and has minimal deviations from this price. If you open a plan in USDT for 365 days, you can get up to 18,64% per annum.

Over 40 assets are available in the Crypto Lending section, including Bitcoin (BTC), Ethereum (ETH), USDC, etc.

We have updated the product to improve the user experience:

- The page displays more information about the plans, which allows you to quickly get acquainted with all the indicators, compare them, and choose the best option;

- We have added a calculator that will help you plan and allocate the budget, as well as calculate the potential profit;

- Now it is possible to view active plans and the history of all deposits;

- A search has also appeared on the page. With its help, you can quickly find any asset.

How to earn using Crypto Lending?

To earn thanks to Crypto Lending, it is enough to keep a digital asset for the period provided for by the chosen plan. You are guaranteed to receive a percentage of the profit at the end. The longer the plan, the higher the percentage.

For example: On the 1st of April 2023, you opened a 360-day Crypto Lending plan, where you deposit 1 BTC for $20 000. When the plan ends, you will receive back the invested asset + 17,39%, totaling 1.1739 BTC. The asset’s price during this time can grow to $30 000, then you will receive $35 217.

The digital asset market is volatile, but you can always play it safe and deposit stablecoins with a fixed or steady rate — for example, Tether (USDT) or USD Coin (USDC). In addition, when choosing a plan for 360 days, you can get up to 18,64% profit.

As a reminder, in the summer of 2023, we changed the mechanism for calculating the commission for using borrowed funds in Margin trading, also interest and plans for Crypto Lending were changed.

How to open a Crypto Lending plan on WhiteBIT?

- To get started, choose an asset you will use for Crypto Lending and deposit your balance.

- Open the WhiteBIT Earn page for available plans, periods, and interest rates.

- Select the asset and the period during which you plan to keep it. Then click the “Choose plan” button. In the window that appears, enter the amount and click the “Choose plan” button again.

Kindly note that each plan has a minimum and maximum amount. Moreover, additional funds can only be deposited after it has been opened.

The plan will close automatically at the end of the specified period, and your funds and interest will return to the Main balance. You can close the plan ahead of schedule, but in this case, the funds will be returned without interest.

What are the advantages and disadvantages of Crypto Lending?

Advantages:

- Guaranteed passive income with fixed remuneration at the end of each period. To start making a profit, you only need to choose an asset and a suitable Crypto Lending plan. It is not enough to buy an asset and keep it in an exchange wallet. You must open a plan in the Crypto Lending section to earn money.

- You can open or close attachments in a few minutes. Plan statuses are displayed in the Active Plans and History sections. You can withdraw a deposit in a digital asset at any time in full, but without remuneration.

Disadvantages:

- The digital asset market is highly volatile. This financial indicator characterizes the degree of fluctuation in the instrument’s value. For example, the price of the first cryptocurrency, Bitcoin, is volatile. In November 2021, quotes for 1 BTC ≈ $69 thousand, while in November 2022, 1 BTC ≈ $16 thousand. In percentage terms, the difference is more than 75%

Price dynamics vary from asset to asset. The higher the volatility, the higher the risk, but the potential return will also be more significant. If the asset price that users put on the selected plan decreases, the losses may exceed the income from interest.

When you put assets on Crypto Lending, you can no longer interact with them or conduct transactions. Nevertheless, they are displayed in the history, so you can always keep up-to-date and return the funds to the Main balance at any time.

What assets are profitable to invest in Crypto Lending?

You can earn on almost any cryptocurrency. For example, on WhiteBIT, you will find Crypto Lending plans for over 40 currencies. As a rule, users choose Bitcoin, Ethereum, or Cardano, as these projects have large market capitalization. However, by betting on them, you always risk falling in the instrument’s price. If this happens, the losses may exceed the crypto platform’s interest income. You can deposit stablecoins: Tether (USDT) or USD Coin (USDC).

With Crypto Lending, you can invest in digital assets in the hope that the value will grow over time and receive passive income from your savings. In addition, compared to traditional bank investments, “digital” deposits give a much higher return.

FAQ

Crypto Lending is a great way to get passive income using assets. Especially if they are just lying in your wallet, and you don't plan to sell them soon.

To get started, choose the right platform and the assets you want to invest. The choice depends on market conditions, desired returns and whether you are ready to risk or not.

Lending can be safe if you take the proper precautions choosing an exchange and an asset. However, it is also associated with risks, like any other investment or financial activity.

In the case of WhiteBIT, there is no need to worry about the security of funds. We store 96% of digital assets in cold wallets and use WAF to detect and block hacker attacks. Besides, users can close the plan at any time and get their funds back. But in this case they don’t get the desired percentage of profit.