What is KYC: Meaning, Process, and Advantages

Content

To ensure the security of financial transactions and combat fraud and money laundering, a need to abandon the complete anonymity of users occurred. That is why most cryptocurrency exchanges have a standard procedure – KYC verification. In this article, we will tell you about KYC’s meaning, what its benefits are, and how to pass KYC on WhiteBIT.

KYC verification: what does it stand for?

Many crypto traders facing this term wonder: “What does KYC mean?”. Well, let us explain. KYC is the verification of a user, the confirmation of their identity by requesting personal data. It is the abbreviation for “Know Your Customer” or “Know Your Client”. The difference between Due Diligence and KYC is that the first one checks if the information provided by customers during registration is correct and does not collect data.

Although the KYC definition is unified, there are no international KYC regulations. The USA, UK, Germany, and so on have different verification standards. Cryptocurrency exchanges also have different KYC requirements, verification duration, and benefits that the client receives.

Many users do not want to provide information about themselves, taking care of the security of confidential data. Still, it is worth remembering that online verification indicates the exchange’s reliability. The platform that does not require any data is not liable to you. If you visit a crypto exchange with no KYC required and hope to buy Bitcoin without KYC, take responsibility for possible risks.

What are the advantages of identity verification?

Client verification is a mutually beneficial procedure for a centralized platform and traders. Therefore, there are advantages for both parties. The exchange receives information about customers, their risk profile, and financial position. Instead, customers receive enhanced protection of their account and a set of features that are not available to users who have not passed verification.

In addition, the Know Your Customer principle minimizes the risk of theft and helps establish the “purity” of suspicious transactions.

Speaking of identity verification pros and cons, it is hard to name the drawbacks. The only disadvantage of verification is the loss of anonymity, which is so valued by members of the crypto community because it is one of the main features of cryptocurrency. However, if you have nothing to hide, do not be afraid of identity verification. It is up to you to choose between security and anonymity.

Speaking of exchanges, they will face additional costs for employees, their training, specialized software, and security of identity verification documents.

KYC and AML compliance

AML, Anti-Money Laundering, is part of the policy of any self-respecting exchange and is of great importance for the security of the finances. The name itself suggests that AML is a set of measures and laws to combat money laundering. This category includes funds received from drug trafficking, child exploitation, the creation of weapons of mass destruction, and so on. AML is also closely related to Counter-Terrorist Financing, CFT.

Due to the anonymity of cryptocurrency transactions, the digital asset market has become an attractive environment for money laundering. It plays into the hands of attackers and harms honest users, tarnishing the reputation of crypto. Therefore, there is a need for AML and KYC.

AML connects the KYC database and other sources of information to analyze transactions, identify suspicious actions and verify them by comparing data on verified users and addresses in the blockchain. Thus, after people start mass passing KYC, crypto will be safer because it will be easier to track “dirty BTC” and punish the guilty. So, never underestimate the KYC verification meaning for safety and security.

How to Pass Identity Verification on WhiteBIT?

Identity verification (KYC) is the process of identifying the exchange’s clients. It allows us to protect our users’ data. Trading, exchanging, depositing, and withdrawing crypto assets on our platform become available after passing identity verification.

With our verification, you can quickly apply your data and documents. The process takes only several minutes and doesn’t require any technical skills. As usual, the process takes place on our exchange. Here is the instruction:

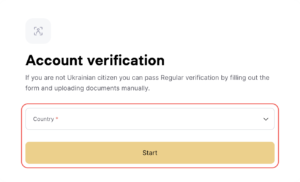

- Choose your nationality and country. Be sure to choose a country from the white list.

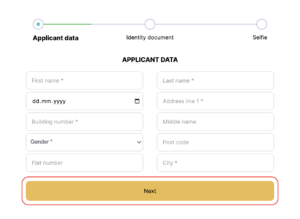

- Fill out the form, providing your data. Specify your first and second names, sex, birthdate, and residence address in it.

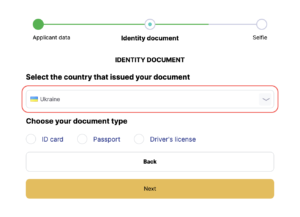

- Choose the document to verify your identity. There are 3 options: ID Card, Passport, and Driver’s license. Pick the most convenient option for you and upload the document.

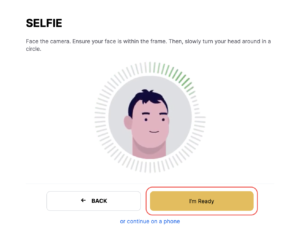

- Take a selfie. It makes the verification procedure easier and faster. All you need is to turn your head side to side according to the interface instructions. You can make it through either your phone or desktop.

- Finish the identity verification process by enabling 2FA* for extra account protection.

2FA, or two-factor authentication, is a code generated by an app that ensures you’re the only person with access to your account.

Done! Soon, you’ll know the verification status. We will send you a letter as soon as we check your documents. You can also check the status in your account.

It’s possible that your documents won’t get approved. But don’t take it to heart. We allow you to try one more time if your data was disapproved.

You can pass identity verification on your device if you prefer using only your phone. It’s as easy as on the web. You just have to sign up on our exchange through our app and apply for identity verification. Follow the same instruction that we have described above.

Congrats on passing your first steps on our exchange. Set the level with every step you make!

Identity verification is an essential element of any reliable cryptocurrency exchange, which benefits both the platform and its users, protects traders' assets, and prevents criminal money laundering. Getting verified deprives users of complete anonymity but gives the privileges of a verified account instead. Complete identity verification now and enjoy even more secure trading!

FAQ

KYC stands for "Know Your Customer", which means the procedure of verifying the user's identity. KYC, meaning crypto exchange’s online check is present on most trading platforms, is often optional but gives users many benefits.

User verification is vital in the fight against money laundering. It provides additional protection for accounts. You will also be able to restore your account if you lose your 2FA code.

KYC and AML are two different terms that are closely related and can often be seen side by side. AML (Anti-Money Laundering) is a set of measures to combat the laundering of money obtained illegally. KYC is part of AML. If there are doubts about the “purity” of your transactions, AML with Know Your Customer checks will prove that these are your honestly acquired assets. That is why KYC is necessary.