Optimized Trading with GoodCrypto: An Overview of Trading Tools

Content

The digital assets market is volatile. Therefore, traders must have access to the right tools and information to make informed decisions and maximize their profits. GoodCrypto is a platform that aims to help traders optimize their trading strategies and succeed in the cryptocurrency market.

In this article, we will look at the advanced trading orders, smart order combos and trading bots that can be used via the GoodCrypto platform on WhiteBIT, and how they help you get the most out of trading.

What trading order can I place with GoodCrypto?

GoodCrypto is the best crypto app that has a plethora of tools and features including a variety of advanced trading orders that help crypto go-getters implement and improve their crypto trading strategies. Here are some of the most popular ones:

- A market order is buying or selling an asset at the current market price. It guarantees quick execution but does not guarantee a specific execution price;

- A limit order allows you to set a price limit to execute the transaction only at the specified price or a better price but does not guarantee its execution. A limit order helps to avoid “slipping” the price in the order book;

- Stop loss is an order to sell an asset at or below a specific price. It is used to reduce losses in case the market moves against the trader’s position;

- Take profit is an order to sell an asset at a specific price or higher. This order locks in profit when the trader’s position is profitable.

- Trailing stop is a particular type of order in the financial market that follows the movements of the price of the asset and automatically changes the Stop-loss level to protect profits or reduce losses. This order can also work as a dynamic Take Profit enabling a trader to ride the trend till its end;

- Trailing stop limit is an order that allows the investor to set a limit on the maximum possible loss without setting a limit on the maximum potential profit. It can work as a dynamic Take Profit as well.

It should be noted that GoodCrypto’s orders don’t freeze a trader’s assets before execution allowing traders to use their assets to open new trades or make other transactions.

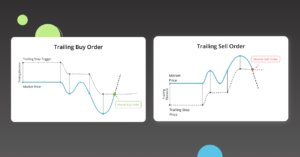

What are Trailing-stop orders?

Trailing-stop sets a trigger that “slides” along the market price and remains at a given distance (trailing distance) while the price moves in the chosen direction. But it stays in place if the price moves in the opposite direction. If the market price reaches the trigger, the underlying order is executed.

This is an excellent tool for entering or exiting a long or short position when a price trend unfolds and buying or selling assets at better prices. Trailing stops allow you to ride the market as long as it continues to move in your favor boosting your profit while minimizing the risk of loss on every trade.

Dive deeper into all the nuts and bolts of trading with various Trailing stop order strategies in a definitive guide by GoodCrypto.

The difference between the Trailing-stop and Trailing-stop-limit orders

Trailing-stop and Trailing-stop-limit are two different types of orders used in trading to protect against losses and secure profits automatically.

Trailing-stop allows the investor to protect the position from losses and ensure profit, as well as gain extra profit if it’s used as a dynamic Take Profit. When placing Trailing-stop, a trader sets a level at which they are ready to suffer losses (Stop-loss) or fix profit (Take-profit). Suppose the asset’s price moves against the position and reaches the set level. In that case, the order is automatically executed, and the position is closed with minimal loss. However, unlike traditional (static) Stop-loss, the Trailing order follows the price and if it increases, let’s say by 10%, GoodCrypto will move the Stop-loss level by the same 10%. The same works with Take-profit. If an asset’s price keeps increasing, GoodCrypto will move the Take Profit level higher and you will get an extra profit.

The Trailing-stop-limit combines the features of a trailing-stop order and a limit order. The trader sets not only the Stop-loss trigger price but also the limit price that must be reached to fill the Trailing Stop Limit order. This means that if the asset’s price reaches the trigger price, the order will be delayed until the asset’s price goes to the limit price, after which the order will be executed at the limit price or better.

So, the main difference between Trailing-stop and Trailing-stop-limit orders is simple. One works according to the Market-order principle, and the second as a Limit Order. A trailing-stop-limit order adds an additional limit price to the stop order, providing more control and certainty over the execution price. Trailing-stop allows traders to hedge their positions flexibly, while Trailing-stop-limit can help preserve higher profits in an upward price movement.

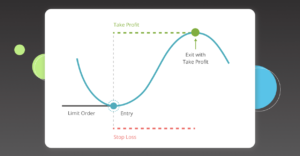

Stop-loss and Take-profit orders

If you’re looking to trade cryptocurrencies, it’s essential to have a solid risk management strategy in place. That’s where stop-loss and take-profit orders come in. These orders allow traders to protect their positions and maximize their profits in the fast-paced and ever-changing world of crypto trading.

Stop-loss orders are used to limit potential losses if the market moves against the trader’s position. Stop-loss is placed at a price lower than the current market price and allows a trader to set a maximum amount of losses they are willing to incur. If the asset price falls to the Stop-loss level, the position is automatically closed (by Market or Limit order), allowing an investor to reduce possible losses and protect their capital.

Take-profit orders, on the other hand, are used to lock in profits when the market moves in the trader’s favor. Take-profit is placed above the current market price and allows a trader to set a maximum amount of profit they would like to make. If an asset’s price reaches a Take-profit level, the position is automatically closed, allowing an investor to secure a profit and increase capital.

Both warrants are essential for traders who want to manage their positions and risks. According to the calculations, the investor can set Stop-loss and Take-profit at different levels relative to the current price, depending on the goals and strategy. Usually, Stop-Loss and Take-Profit ratio is equal to or higher than 1:2.

In the GoodCrypto app, you can attach Stop-loss and Take-profit combos at once to every order you send with no balance lock. Moreover, you can set the timeout trigger for Stop-loss. It allows you to avoid a premature exit from the position on a short-term price spike. In other words, you can set up the whole position in a few clicks with no need to exit it manually later. GoodCrypto will do everything for you.

GoodCrypto trading bots

GoodCrypto offers several trading bots to help traders automate their trading strategies and increase profits while trading on WhiteBIT. Let’s consider every automated trading strategy separately:

Grid Bot

Grid trading bot automatically places and maintains a grid of Buy and Sell Limit orders of the same size and step within a set range. When a Buy order is executed, the bot places a Sell order one level higher. Similarly, the bot places a Buy order at the grid level below when a Sell order is executed. The Grid bots will run continuously until it reaches a set profit level. Or until the trader stops it on his own. GoodCrypto offers two more grid bot types: Long for bullish markets and Short for bearish ones. Read more in the WhiteBIT bot manual by GoodCrypto.

DCA Bot

This bot helps traders accumulate assets over time and make a desired profit by averaging the position down if the price moves against you while automatically adjusting the Take-profit level to reflect the current size of your position.

Depending on the direction of the market, there are two types of DCA:

- Long — places additional buy orders when the market is growing;

- Short — places additional sell orders when the market is falling.

With each order execution, the bot sets a new Take-profit level, considering the size of the order and the entry price.

Infinity Trail Bot

The bot performs multiple trades using Trailing-stop orders, thereby, capitalizing on market volatility. Thanks to this, traders can enter a position during a reversal of a downtrend and exit it exactly when an uptrend exhausts itself. You only need to set the trailing distance for Trailing-buy and Trailing-sell orders and launch the bot. In GoodCrypto, you can define a PnL drawdown level that will act as a Trailing Stop Loss for your bot.

Final thoughts

GoodCrypto is a cutting-edge app that offers a professional trading terminal with a suite of sophisticated trading tools, including automated trading strategies, customized trading orders, such as Stop-loss and Take-profit combos or Trailing-stop orders, charting & technical analysis tools, and a lot more wrapped in a user-friendly UI/UX with simple and intuitive setups.

Stay ahead of the game and take your trading on the WhiteBIT exchange to the next level with the GoodCrypto app.