What Is Bitcoin Dominance (BTC.D) And How To Use It For Crypto Trading?

Content

Bitcoin is always on the radar in the cryptocurrency market. Its role is so significant that investors and traders seek ways to understand and utilize its influence to improve their trading strategies. One of the factors influencing the market is Bitcoin’s dominance.

This article will explain what is BTC dominance and why it is essential for cryptocurrency trading. We will examine how it affects the market, what analysis methods exist, and how traders can use this information to make informed trading decisions. We will also discuss the factors that influence changes in Bitcoin dominance and strategies that can be applied in different situations.

BTC Dominance Meaning

Bitcoin dominance is a metric that reflects the share of Bitcoin’s market capitalization relative to the total market capitalization of all cryptocurrencies.

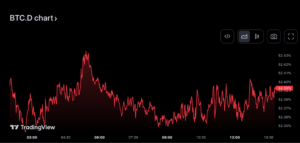

Bitcoin Dominance Chart (BTC.D chart)

This metric is critical in assessing Bitcoin’s impact on the cryptocurrency market. The BTC dominance chart live helps us understand current trends and investor sentiment. A high level of Bitcoin dominance usually indicates its dominance in the market and may indicate a conservative investor sentiment. On the other hand, a decrease in dominance Bitcoin signals a growing interest in alternative coins (altcoins) and riskier investments, which is characteristic of bull market periods.

Historical Background on the Bitcoin Dominance Index

- The emergence of Bitcoin: Since its inception in 2009, when Satoshi Nakamoto launched Bitcoin, it had no competitors and completely dominated the market.

- Development and emergence of altcoins: In 2011, Bitcoin broke through the price of $1. The coin became so popular that an article about it was published in TIME. By June 2011, a single bitcoin was worth over $29. Bitcoin’s market share gradually declined after coins like Litecoin and Namecoin emerged. It remains the leading cryptocurrency, but altcoins began actively trading and speculating in the market.

- Growth peak and volatility period: From 2017 to 2020, the cryptocurrency market experienced significant fluctuations. In late 2017 and early 2018, during the first prominent peak, Bitcoin’s dominance fell due to the ICO (initial coin offering) boom and increased interest in altcoins.

- The era of institutional investors: Since 2020, when the market began to attract them, Bitcoin’s dominance has once again become an important indicator reflecting the confidence level in the cryptocurrency market. Bitcoin began to be considered “digital gold” during this period. In November 2021, the price per Bitcoin was $69,044.

By analyzing the BTC chart, you can see how changes in the market capitalization of Bitcoin and altcoins have affected its position in different historical periods.

How To Use Dominance BTC In Trading?

The Bitcoin Domination Index (BTC.D) is a valuable tool that helps traders make informed trading decisions based on market trends.

BTC.D Is Growing

- Bitcoin Investing: If BTC.D rises, it often means increased confidence in Bitcoin. Bitcoin’s high dominance can indicate a conservative mood in the market, making Bitcoin a safer choice over riskier coins.

- Selling altcoins: If you have altcoins in your portfolio, increasing Bitcoin’s dominance may signal that you should sell them.

BTC.D Is Decreasing

- Buying altcoins: When Bitcoin’s dominance diminishes, it often means a rise in the popularity of other coins that can offer high returns. Such a period can be an excellent opportunity to buy crypto and diversify your portfolio.

- New investment opportunities: Analyzing the market and finding coins with growth potential is essential. The decline in BTC dominance typically coincides with the rise of individual altcoins, which creates favorable conditions for speculative trades.

- Signaling the beginning of a bull cycle: A drop in Bitcoin’s dominance can also indicate the onset of a bull market.

The BTC dominance today helps in understanding the overall mood of the market. Bitcoin’s dominance in the market typically indicates a conservative approach by investors who prefer stability. Conversely, a low may indicate an increased interest in altcoins and a heightened appetite for risk.

By analyzing the relationship between BTC dominance and the price of cryptocurrencies movements, traders can identify significant correlations and anomalies that can be used to develop trading strategies. However, Bitcoin dominance is only one of the analysis tools. It should be combined with other indicators and analytical tools, considering market conditions, news, fundamental and technical analysis.

BTC Dominance vs. Altcoins: Impact On Other Crypto Assets

Bitcoin’s dominance has a significant impact on all cryptocurrencies. This indicator not only reflects the distribution of market capitalization among cryptocurrencies but also expresses the general sentiment of investors. A high Bitcoin dominance often indicates investors’ preference for reliability and stability. In contrast, a decrease in its dominance may indicate a growing interest in riskier coins, which is usually a sign of a bull market in the segment of these assets. This index influences market liquidity and volatility and is an essential strategic investment planning and trading tool. It helps traders adapt to the dynamic cryptocurrency market conditions. In addition, a decline in Bitcoin’s dominance may signal the beginning of the alt season, when interest in other coins increases and opportunities for high returns in this market segment increase. Find out what is altcoin season index.

Pros And Cons

Bitcoin’s dominance in the cryptocurrency market has its pros and cons, which are essential for both experienced investors and beginners to consider.

Pros

- Stability and Confidence: Bitcoin, being the oldest and most recognized cryptocurrency, is considered a relatively stable and reliable asset, especially during periods of economic instability or market downturns.

- Market Sentiment Indicator: Bitcoin’s high dominance can indicate conservative market sentiment, allowing investors and traders to adapt their strategies accordingly.

- Risk reduction: Portfolios dominated by Bitcoin may have lower risk because it is less prone to volatility than many altcoins.

Cons

- Limited diversity: Bitcoin’s high dominance can inhibit the development and growth of altcoins, as much of the capital is concentrated in one asset.

- Volatility: With high Bitcoin dominance, altcoins may become more volatile and risky due to reduced liquidity and increased speculative interest.

- Market Dependence: The overall dependence of the cryptocurrency market on Bitcoin dynamics may reduce its potential as a diversified investment alternative.

How To Check BTC Dominance Chart?

You can use platforms like CoinMarketCap or TradingView to check Bitcoin’s dominance graph. These sites offer detailed charts and analytical data on the market cap BTC dominance share compared to other cryptocurrencies. A graph can help you analyze historical trends and understand how Bitcoin’s market share has changed in response to various market events and news. Some of these platforms also offer technical analysis tools that can be useful to understand market trends better.

Conclusion: Why is Bitcoin Dominance Important?

Bitcoin’s dominance is a critical factor in the cryptocurrency market, as it reflects the balance between the most established and influential cryptocurrency and the variety of alternative digital assets. This indicator is important for several reasons: first, it serves as a barometer of market sentiment, indicating how investors allocate their capital. Secondly, Bitcoin’s dominance affects volatility and liquidity in the cryptocurrency market, influencing strategic planning and risk management. Understanding this indicator allows traders and investors to manage their capital more effectively and make informed decisions.