What is a crypto exchange with a demo account?

Content

Digital assets and blockchain are becoming more and more popular, and many people want to join this new promising industry. However, theoretical knowledge is not enough for beginners to trade on a crypto exchange. Cryptocurrencies are very volatile, and the market is unstable. Practical experience is essential to stay calm, timely identify trends, and respond to them using the most appropriate tools available. But where to get experience and learn how to trade without risking losing money? The answer is simple – you need a demo account on a cryptocurrency exchange. In this article, we will discuss what it is, focusing on its main advantages and disadvantages.

The pros and cons of crypto exchanges with demo accounts

Demo trading is a simulation of actual trading. Transactions are carried out in real time, but you are using virtual funds with no monetary value. They are created and issued by the exchange. Demo assets cannot be deposited to or withdrawn from the platform. They are stored in a separate account and can only be used on the exchange where they were created.

The advantages of the platforms with a demo account

A crypto exchange with a demo account can be helpful for both experienced and newbie traders. Firstly, if you are a beginner, you can find out if you like trading and determine how easy or difficult it is for you without the risk of losing coins. If you already have some experience, a demo account will be useful for developing and testing new strategies. Sometimes traders get so excited about a new idea that they overlook obvious flaws in the strategy, thus making rash trades that can lead to losses. Working with a demo account allows users to test strategies, find weaknesses, and make the necessary adjustments.

Besides, demo trading is a great way to learn how to manage a deposit while tempering emotions. The crypto market is young and unstable, and sometimes everything goes not according to the initial plan. Keeping a cool head facing both disastrous and successful trades is essential. Fear, greed, and hope for success are the primary emotions you need to learn to control when trading. Some digital assets are more volatile and some are less. Demo trading allows you to study the assets and be prepared thoroughly.

Crypto exchanges with a demo account are also convenient because users have the opportunity to try out all the available tools, use technical analysis, and learn about the trading stages before buying or depositing their cryptocurrency on the platform. There are many exchanges, and each offers different features and interfaces. It is essential to find a platform where everything is as convenient and straightforward as possible. This can influence the development of your unique vision and help you achieve your goals swiftly.

The disadvantages of demo trading

Although demo trading is a simulation, this feature has disadvantages that can negatively impact the formation of your trading style:

- The most apparent advantage of demo trading is also one of its most significant disadvantages. We are talking about risk-free trading. On the one hand, it is convenient and is the right thing to do. If users have no experience, they need to learn the tools and try out all possible “What if …?”. On the other hand, traders may develop a habit of making reckless trades due to this pattern.

- Another disadvantage is not obvious at first glance. It is a different speed of operations. Demo trading works on the test net, so transactions are carried out instantly. In the real market, all transactions are conducted longer. Neglecting this factor on the real market can lead to problems with time management and to financial losses.

- Despite the significant similarity between demo trading and actual trading, they may differ. It is especially noticeable in a fast market caused by news or hype. Under such circumstances, the system’s performance may differ significantly due to the high network load.

- Some users are so much into trading that they become addicted to their emotions in the process. Once on the real market, such traders may not stop in time and lose their deposits. To reach success, sometimes it is better to be idle for a while than to enter risky trades for the sake of thrills.

Which crypto exchanges provide demo accounts?

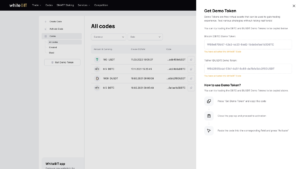

The demo trading option is available on multiple platforms. The choice of a suitable exchange for opening a demo account comes down to the user’s personal preferences. Opening a demo account on WhiteBIT takes a few minutes. After registration or authorization, go to the Codes page and select “Get Demo Token” in the menu on the left.

Each registered user can obtain 1000 DUSDT and 0.5 DBTC. Choose an asset and copy the code. Then click “Activate code” in the menu on the left and paste it into the corresponding field. After the activation, you will get access to the exchange’s tools in demo mode. Both regular and unique order types are available on WhiteBIT. You can explore all of them with the help of Demo Tokens.

If you got bored just trading demo assets, try the demo mode on Nominex. Here you can learn how to use the functions of the platform and participate in daily demo tournaments where you will compete with real traders.

Conclusion

Demo trading on the exchange is an imitation of the real market. It is a great way to try out the platform’s functionality, learn how to trade, and test new strategies without the risk of losing money. Demo trading is helpful for both beginners and advanced users.

FAQ

It is a complete simulation of real trading. The difference is that you use virtual assets with no monetary value, so you do not risk losing funds.

Each registered user can obtain 1000 DUSDT and 0.5 DBTC.