How to Buy Cryptocurrency?

Content

What contributed to the emergence of digital currencies?

The global economic crisis of 2008 turned out to be a real engine of progress. Its scale and impact were comparable to the Great Depression of the 1930s. As a result, the traditional financial system lost the trust of the majority of people.

Digital assets, in turn, tend to be decentralized and independent. The need arose due to vulnerabilities and errors in the centralized structures that prevailed then, banks and another commercial financial institutions. Clients’ money belongs to the bank, and its centralized nature makes it legal to devalue savings through additional emissions of the national currency. Clients are forced to trust banks with their funds, not having the authority to monitor their work and structure.

However, the decentralized payment systems eliminate these problems, as the network operates without the participation of a regulatory authority. It is designed so that no one can control or block it. Nevertheless, anyone can use it to transfer funds and join the network, developing and improving it.

Simply put, a decentralized system is built and maintained by its participants. All users’ balances are public, and their personal information remains hidden. In the network protocol, there are mechanisms that regularly check the validity of the data.

In 2019-2022, due to the acute economic and political situation, people were looking for a way to save and increase their savings.

- How to buy cryptocurrency?

- Where can this be done quickly and profitably?

- Where to start investing in digital assets, and which ones to choose?

- How to avoid fraud, and what security measures to follow?

- Where to store digital assets after purchase?

Now is one of the most opportune moments to finally understand digital assets. This guide is for you if you are a beginner and need help figuring out where to start.

Where to buy cryptocurrency?

There are many different platforms to purchase digital assets, among them:

- Cryptocurrency exchanges (CEX, DEX);

- P2P platforms;

- Online and offline exchangers;

- Over-the-counter trading (OTC);

- Cryptomats (Bitcoin ATM).

The best safe place for purchasing crypto coins is a centralized exchange. It is a specialized platform that allows users to conduct transactions with digital currencies around the clock. These platforms provide various assets, various ways to top up the balance (including bank cards), and a 24/7 support service.

Let’s take a closer look at how to invest in cryptocurrency separately for each option.

Cryptocurrency exchanges

Cryptocurrency exchanges are platforms for buying and selling digital currencies. Exchanges are online platforms where users buy and trade crypto assets. They provide the registered audience with additional opportunities and tools.

For example, WhiteBIT users can use WhiteBIT Earn, a modern alternative to the classic bank deposit, only in digital assets, with higher interest rates. The percentage depends on the selected asset and the holding period. As a rule, you can get from 0.4% to 30%.

Crypto exchanges are divided into centralized (CEX) and decentralized (DEX).

Centralized Exchanges (CEX)

These are platforms whose work is regulated by the “central governing body,” the project team. CEX also provides a built-in storage wallet.

Centralization allows these platforms to work in the legal field, protect users’ assets and work with fiat (state) currencies. The exchange is responsible for the assets’ safety and helps restore access to the account.

Centralized exchanges comply with the financial laws of the country where they are registered. To enjoy access to the trading tools of CEX, you need to pass the identity verification procedure, KYC (Know Your Customer). The process presupposes the user uploading their documents, address, and other personal data.

On the one hand, the centralization of exchanges contradicts the main principle of digital assets, the absence of one controlling body. The administration of the exchange has access to its users’ accounts and can, upon request, transfer data to government agencies or block the account.

On the other hand, centralized exchanges have a staff of specialists who ensure the protection of assets and data. For example, WhiteBIT stores 96% of assets in cold wallets and uses WAF (Web Application Firewall) to block hacker attacks promptly. In addition, WhiteBIT has an AAA rating and is one of the three most secure crypto exchanges, according to CER.live.

How to buy cryptocurrency on the WhiteBIT exchange?

You can purchase a digital asset on our exchange through an exchange option or by placing a trading order. But before that, you must create an account, pass quick verification and deposit your balance.

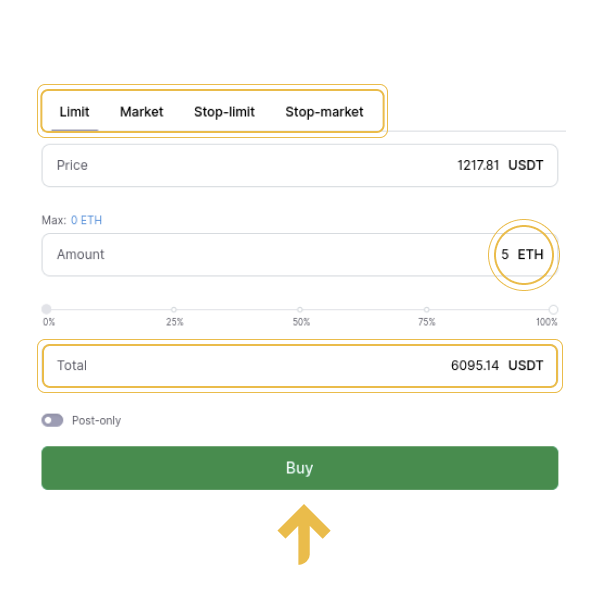

Let’s see how to place an order.

- In the upper left corner of the menu, select the Trading tab, and in it, click on “Spot.”

- Select the trading pair from the list on the terminal’s right side.

- At the bottom of the terminal, select the order type.

- In the Amount field, enter the desired quantity of the asset and click “Buy.”

- The funds will be accrued to your balance immediately.

You can also use the Quick Exchange tab, which is also in the Trading section. In the window that opens, indicate the cryptocurrency you want to exchange and the one you wish to receive. In the “I give” field, show the desired amount of the asset to be exchanged and click “Exchange.”

There are 350+ trading pairs on WhiteBIT, and large liquidity pools allow concluding significant trading deals.

Decentralized Exchanges (DEX)

To trade on the DEX, you do not need to verify your identity and provide personal data; connect a suitable crypto wallet. Users are responsible for the safety of their private keys. Therefore, decentralized platforms are less secure.

DEX’s disadvantages include less liquidity than CEX and high exchange fees.

You can’t buy cryptocurrency if you don’t already have it on the DEX. To start trading on the DEX, you will first need to buy assets using different services or online exchangers, create a crypto wallet and make a transfer. Popular multi-currency crypto wallets are MetaMask, Exodus, Atomic, etc. If anonymity is important to you, remember that third-party services may require identity verification (KYC) before purchasing.

DEXs are popular among more experienced users. A good example is WhiteSwap, an AMM exchange (with an automated market maker) running on the Ethereum and Tron blockchains. It has its governance token, WSD, allowing its holders to participate in the project’s development.

Online exchangers

In addition to the methods described above, you can buy cryptocurrency from online exchangers. These services allow you to exchange national currency for cryptocurrency and vice versa quickly. It can be done online, via card transfers, and offline, in cash.

Registration and identity verification are not necessary in this case. But for large-sum transactions, the exchange service may request your data. As a rule, users need to leave a request for an exchange. The transaction details are negotiated when the operator contacts the user, but automatic exchange is also possible.

A characteristic feature of online exchange is the limit on the maximum available amount of assets. Most exchanges are limited to amounts up to 0.1-0.3 BTC (or another asset in this equivalent). Some sites offer a higher limit. As a rule, restrictions are due to the possibility of blocking transactions by the bank.

Basically, you can change BTC, ETH, and USDT online, but the choice of assets depends on the service. When choosing a service, remember that not all sites are licensed or registered as legal entities. The services themselves sometimes indicate this information on their websites, but the risk of running into scammers is high.

Data on quotes and available liquidity in online exchangers is published, for example, by the Bestchange service. You can also see a list of the most popular exchange sites and reviews about them.

P2P platforms (Peer-to-Peer)

Peer-to-peer platforms allow you to trade without intermediaries and work like a bulletin board. To invest in cryptocurrency, you must sign up and place an ad. Your ad should specify the amount of the asset, price, terms and payment method, transaction limits, and margin.

After placing an advertisement for buying and selling, the required amount of assets is algorithmically transferred to a temporary deposit. The exchange will be made once both parties confirm the transaction.

All users on the P2P platform have a rating, based on which you can choose the participants in the transaction.

The benefit of P2P trading lies in the minimum fees, the ability to refuse a deal, and an intuitive interface.

Crypto ATMs

To exchange cryptocurrency for the national currency, you can use crypto ATMs. These special terminals allow you to buy and sell Bitcoin and other cryptocurrencies for cash.

These devices send BTC to a cryptocurrency wallet in exchange for government currency. All you need to do is insert money into an ATM and then provide an account number or scan the QR code of a crypto wallet. Crypto ATMs charge a fairly high fee (up to 20%) but do not store customer data. Sometimes, you need to verify your identity to finalize the purchase.

The nearest machine to buy BTC you can find on the Coinatmradar website.

Offline exchangers

These are physical cryptocurrency exchange points that function like regular exchangers. In exchange for the national currency, the client receives a digital asset.

The peculiarities of offline exchange are its limits and narrow focus. Physical exchanges focus on a few major cryptocurrencies and set a high minimum exchange volume. As a rule, you can buy cryptocurrency in an offline exchanger for the equivalent of 0.5 BTC. Large market players most often advocate this method of purchasing digital assets.

How to start investing in cryptocurrency?

Risks are everywhere, especially if you’re a beginner. To keep and multiply your investments, you must choose an asset, evaluate the project, prepare for possible risks, determine the budget, and choose the right strategy.

The result depends on how much time you spend studying the aspects described above.

What are the most popular digital assets?

According to CoinMarketCap, these three cryptocurrencies are the leading representatives of the industry:

- Bitcoin (BTC) is the market’s first and most popular coin. Fluctuations in its price correlate with the price of other assets.

- Ethereum (ETH) is the second coin by capitalization. The Ethereum network supports smart contracts, with EVM (Ethereum Virtual Machine) providing for their smooth operation.

- Tether (USDT) is a stablecoin pegged to the US dollar at 1:1.

When choosing an asset, do your research: study its documentation, look at the history of price formation, and also find information about the creators and goals.

How to buy cryptocurrency safely?

At any stage of interaction with cryptocurrency, you may encounter scammers. Regardless of preference, you should only consider purchasing platforms that meet basic security criteria and include identity verification procedures (KYC) and two-factor authentication (2FA).

If you buy cryptocurrencies via OTC, ensure that the intermediary can be trusted.

Where to store cryptocurrency?

A crypto wallet is a key tool for interacting with digital assets on the blockchain. It is software that allows you to create and manage storage and transfer addresses.

In the case of centralized exchanges, each user automatically receives a built-in wallet upon registration.

Hot wallets operate when connected to the internet, whereas cold wallets are hardware devices that don’t require a network connection. As a rule, it is the most reliable way for long-term storage of assets since users do not share access to their private keys, taking complete control over their funds.

There is also a paper wallet, a regular sheet with a printed address, and a QR code you need to scan for transactions.

You can read more about the types and features of crypto wallets in the article on the WhiteBIT Blog.

Conclusion

With the development of the crypto industry, the number of ways and platforms for buying cryptocurrencies has increased. Now beginners can independently purchase digital currencies without technical knowledge.

Even though there’s an abundance of purchasing methods, it is safest and easiest to buy cryptocurrency on a centralized exchange. When using other platforms, you need to make sure they are secure.

Before purchasing a digital asset, carefully analyze the project, as well as the functionality and feasibility of the asset and investment. After the purchase, the coin/token can be stored on an account linked to CEX and on a “cold” wallet.

It is easy to buy cryptocurrency if you follow the rules described above. And the sooner you take the first step, the sooner the digital future will open its limitless possibilities to you.

We wish all your investments to be successful!

With the development of the crypto industry, the number of ways and platforms for buying cryptocurrencies has increased. Now beginners can independently purchase digital currencies without technical knowledge. Even though there’s an abundance of purchasing methods, it is safest and easiest to buy cryptocurrency on a centralized exchange. When using other platforms, you need to make sure they are secure. Before purchasing a digital asset, carefully analyze the project, as well as the functionality and feasibility of the asset and investment. After the purchase, the coin/token can be stored on an account linked to CEX and on a “cold” wallet. It is easy to buy cryptocurrency if you follow the rules described above. And the sooner you take the first step, the sooner the digital future will open its limitless possibilities to you. We wish all your investments to be successful!

FAQ

The leading crypto ratings agree on the top 5 digital currencies for investments that benefit their investors. They are Bitcoin (BTC), the first and most popular coin on the market. Ethereum (ETH) is the second coin by capitalization. The Ethereum network supports smart contracts, with EVM (Ethereum Virtual Machine) providing for their smooth operation.

Tether (USDT) is a stablecoin pegged to the US dollar at 1:1.

You can pay for digital assets with a card on platforms that accept such payment methods. On WhiteBIT, you can buy cryptocurrency with a low fee using NixMoney and AdvCash payment services or directly from Mastercard and Visa bank cards.

To purchase, you must sign up, verify your identity, and specify an asset. When paying, you will have to provide personal data and card details and confirm the purchase

The need for decentralized digital assets arose due to vulnerabilities and errors in the usual centralized financial structures (banks, commercial, financial institutions). Clients are forced to entrust their funds to them, but tracking their work and structure is usually impossible.

Cryptocurrencies eliminate these problems, as the networks operate without the participation of a regulatory authority. No one can control or block the network, but everyone can use it to transfer funds and develop and improve it.

You can buy anything for a digital asset because any cryptocurrency is easily convertible into almost any state currency.