How to Short Crypto: Detailed Guide for Beginners

Content

In market trading, many strategies and tools allow investors and traders to make money from various market conditions. One such strategy that attracts the attention of both experienced users and novices is short trading.

This strategy allows you to make money on a drop in the price of an asset and can be a powerful tool in the hands of a competent trader. What are the mechanics of it? How to make money on the bear market with its help? Let’s take a closer look.

What Does Short Mean in Crypto?

Short or short position is the term that originated in commodity and stock markets and was first mentioned in The Merchant’s Magazine and Commercial Review, Vol. XXVI, January-June 1852:

The Merchant’s Magazine, Commercial Review, Vol. XXVI, January-June 1852.

In the publication, the author complains about the practice of short selling as a “lawless form of gambling.” Even though both short sell crypto and speculation in cotton, flour, and sugar are legal and standard methods of trading in the market, based on strategic analysis and forecasting, not on luck, as in gambling.

With the emergence of a new type of asset, digital assets, and the development of cryptocurrency exchanges, short in crypto selling has also found its place in the industry. This trading method has become an essential tool for investors and traders, allowing them to capitalize on rising and falling asset prices.

So, shorting in cryptocurrency is a trading position where a trader makes money on a drop in the price of a digital asset. In traders’ circles, there is a verb “to short,” which means to open a trade to earn by raising the rate. But how does this happen in practice in the cryptocurrency market?

How Does Shorting Work?

In the publication, the author complains about the practice of short selling as a “lawless form of gambling” without considering that both short selling and speculation in cotton, flour, and sugar are legal and standard methods of trading in the market, based on strategic analysis and forecasting, not on luck, as in gambling.

- Borrowing: To open a short trade crypto position in a particular asset, you must first borrow it from someone who owns it. Usually, this happens automatically through a crypto exchange or a particular broker. Essentially, you are borrowing the cryptocurrency with a promise to pay it back later.

- Selling: Once you have borrowed an asset, you sell it at the current price. This means you now have the cash equivalent of the asset’s value.

- Waiting: After selling the borrowed cryptocurrency, you wait for the price of the cryptocurrency to drop. This is where you make your profit. For example, if you borrow and “sell” 1 BTC at $50,000 and the price drops to $40,000, you can buy 1 BTC again, but at a lower price.

- Buying: To close the BTC short position and return the borrowed cryptocurrency, you buy it at a lower price. Finally, you return the cryptocurrency to the person from whom you borrowed it. Your profit is the difference between the selling price and the price you bought back (cheaper). This price difference is your profit from the short trading crypto position.

But what happens if the price goes opposite to the expected price? The trader will receive a Margin Call — a notice that it is necessary to deposit funds to support the solvency of the position. If additional funds are not deposited, liquidation will occur — forced closing of the unprofitable position. Learn how to calculate the liquidation threshold in our article.

Ways for How to Short Cryptocurrency

Cryptocurrency Futures Trading

Futures contracts are derivative financial instruments, contracts to buy or sell an asset at a predetermined time and price. The parties must fulfill their obligations on the contract’s expiration date, regardless of the market purchase price. When trading futures, the trader is not a direct holder of the asset but can open long or short positions with the contracts.

Crypto futures trading also allows the trader to use leverage, a tool that makes trade with borrowed funds possible.

Margin Trading

Margin Trading on WhiteBIT is a tool that allows you to trade digital assets on the market using borrowed funds and earn not only on the growth of their price but also on the fall. But the logic of their work, unlike futures contracts, is different.

Digital assets, such as Bitcoin, Ethereum, and others, are the trading instruments here. The investor borrows the asset on the security of his funds — margin, which guarantees the payment of debt obligations according to the established rules. You have to pay a commission at an interest rate to use credit funds. Technically, margin trading means that traders buy or sell tangible assets on the spot market — they own the assets they buy or sell.

Beginners often perceive shorting to increase capital, which is a mistake quickly. A successful trader’s priorities are investing in training and developing a strategy and trading plan. In addition, it is essential to understand the risks, considering aspects such as liquidation and short-squeeze.

Where to Short Crypto: Choosing a Trading Platform

When choosing a trading platform to open short positions on cryptocurrencies, it is essential to consider several key factors.

First, you should choose the best exchange to short crypto with a good reputation and a high level of security, as this minimizes the risk of losing funds due to hacking or fraud.

Secondly, paying attention to what pairs the exchange offers is critical. It is also essential to evaluate the market liquidity on the platform, as high liquidity provides smoother execution of trade orders. Trading commissions and spreads are no less critical, as they can significantly affect the profitability of operations. In addition, the appearance of the exchange and the tools for analyzing the market it offers play an important role.

For example, crypto exchange WhiteBIT stores 96% of its assets on cold wallets and uses a Web Application Firewall (WAF) to detect and block hacker attacks.

According to Hacken.io and CER.live’s 2022 audit and certification platform CER.live, WhiteBIT is one of the top three exchanges in terms of reliability with a high AAA rating.

WhiteBIT allows users to short cryptocurrency on the futures and margin market. Up-to-date commissions can be found on the website.

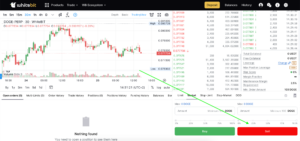

Example of Short Term Crypto Trading on WhiteBIT

Let’s look at how to trade cryptocurrency using the example of a short position on DOGE:

- First, you must make a deposit to your account and transfer funds from the Main Balance to the Collateral Balance. Then, choose a market. In this case, the futures market by opening the “Trade” tab;

- Next, it is necessary to select the order type;

- After that, you must enter the amount and press the red “Sell” button.

Process:

How Do You Short Bitcoin?

- Before opening a short position, it is necessary to analyze the market, decide on the entry point, and consider other aspects. For example, you can use crypto technical analysis to analyze the market.

- Then, you can follow the prevailing trend in the market: bull and bear market provide situations in which you can make money; it is only essential to be able to spot them.

- Use fundamental analysis: Evaluate general market conditions, economic indicators, and specific cryptocurrency news. This will help you determine when the market is overvalued or if a particular cryptocurrency faces fundamental problems. Watching the news is also essential; adverse reports about regulation or security issues can cause prices to drop, creating opportunities for short positions.

- Also, remember to keep track of crypto prices.

These tips will help you take a more informed approach to opening positions, considering technical and fundamental factors affecting the cryptocurrency market.

Long vs Short BTC: What are the Differences

Long positions are buying cryptocurrency with the expectation that its price will rise. One of the most common approaches to trading is based on the classic principle of “buy cheap, sell expensive.” This method is considered traditional for investing. In case of a correct forecast, the trader profits from the difference between the asset’s purchase price and selling price.

In contrast to longing, bitcoin short positions involve selling an asset the trader does not have in stock. This process involves borrowing an asset, which is then sold on the open market at the current price. The purpose of shorting is to repurchase the investment in the future at a lower price, allowing the trader to repay the borrowed funds and profit from the difference between the sale and purchase price. Shorting is considered more risky because if the price of an asset starts to rise instead of the expected fall, the trader takes a loss. This method requires careful market analysis and caution, as the risks and potential losses are much higher than when opening long positions.

Why BTC Long/Short Ratio Is Important?

The Bitcoin long short ratio is an essential indicator of market sentiment, as it reflects the balance between expectations of growth and a decline in the price of this cryptocurrency.

The high level of long positions indicates that most investors are optimistic and expect the price of BTC to rise. At the same time, the active increase in short cryptocurrency may signal growing pessimism among traders, which, in turn, affects the strengthening of the bearish trend in the market.

For instance, the prevalence of crypto short positions indicates predictions of a falling price. Long short ratio bitcoin helps traders gauge the overall market trend and adjust their strategies accordingly. It can also warn of potential sharp price moves, especially if one side becomes too congested. Thanks to the Open Interest or OI indicator, you can track the prevalence of short positions. In simple words, OI is the total volume of long and short contracts for a particular asset that has yet to be closed by executing a transaction. This indicator is an essential tool for market analysis and is used to assess market participants’ current activity and interest in a given asset.

Conclusion

In this article, we explored how to short BTC. Short trading requires a deep understanding of market movements and the ability to analyze news and economic indicators. A common question among traders is, “How do you short crypto effectively?” This highlights the importance of mastering short-selling techniques in the volatile crypto market. The ability to adequately assess risks is critical, especially given the high volatility and unpredictability of the crypto market. Aspects such as choosing the right trading platform and effectively using technical and fundamental analysis play an important role in making informed trading decisions. Overall, shorting cryptocurrency can offer significant opportunities for profit if the trader acts disciplined and sticks to the strategy.