Trading on WhiteBIT for Newbies

Content

Cryptocurrency trading is easy. See for yourself! We have prepared a short guide that describes the working principles with our exchange. In the material, we will walk you through all the stages of trading and exchanging assets, introduce you to the basic concepts, tell you what an order is, how to create it, and what types of orders are available on our crypto exchange.

Read our instructions and try it right now!

How to buy or sell an asset on WhiteBIT?

There are two ways: exchange of cryptocurrency and trading by placing an order. Let’s consider both.

Exchange

This method is suitable for newbies and for those who do not want to bother with trading yet.

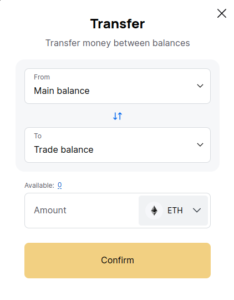

First, you need to transfer your funds from the Main to the Trading balance. To do this, in the Main balance section, click “Transfer” opposite the desired currency.

Enter the desired amount and click “Confirm transfer”.

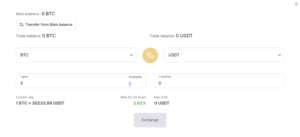

To exchange government currency for crypto and vice versa, go to the Exchange section.

Select the desired pair to exchange. To quickly find the needed asset, enter its ticker in the search bar.

Enter the amount you want to exchange in the “I give” line. The “I receive” field will be filled in automatically. If there is no currency in the “I receive” drop-down list, it means that it is currently disabled.

You can also use the MAX button, which will transfer all funds from your Trading balance to this field, or fill it in according to the current maximum for the glass. For example, if you put up 10 BTC for an exchange (you only have 10 BTC on your Trading Balance), and there are only 5 BTC in the auction now, then when you click on the MAX button, 5 BTC will be substituted in the “I give” field.

If there are no offers for the exchange for the specified pair at the time of confirmation of the transaction, all funds will be returned to your account.

Symbols in the exchange:

- A current rate shows the value of the current rate for a coin or token and changes every second.

- A rate for 24 hours is the rate of the selected pair for today. It changes every second but is not fixed.

- A fee presents the commission percentage in the coin or token you are exchanging for, which is updated and calculated every second.

Recall that in order to make an exchange, you must accept the User Agreement and be a registered user of the exchange.

After entering all the data, click the Exchange button and then “Yes”.

Ready!

All transactions on exchanges can be viewed on the History page.

Trade

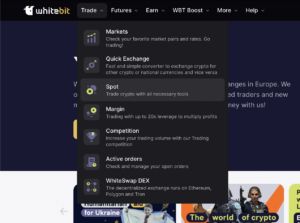

Several types of trading are available on our exchange: Basic, Margin, and Professional. In this article, we will cover the basic section. It is suitable for newbies and those who are not skilled in trading enough.

To buy or sell an asset, follow these steps:

- Transfer your funds from the Main to the Trading Balance. To do this, go to the Main balance section and then click “Transfer” next to the desired currency.

- Enter the desired amount and click “Confirm transfer”.

- Now click on the Trade section and select Spot.

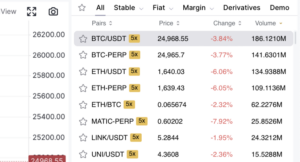

- In the “Market” window, select a pair (for example, BTC/USDT).

Now you can start creating and placing an order to buy or sell an asset. But it can be canceled if it was not accepted or executed.

Order types

There are several types of orders available on our exchange. Let’s analyze each of them in more detail:

- A market order is needed to instantly buy or sell an asset at the current market price.

- A limit order involves buying or selling an asset at a fixed price. This means that you specify the price at which you are ready to buy an asset, and the order is activated only when the price of the asset reaches the mark you set. For example, a limit order to buy an asset at a price of $250 will be activated only when its value is equal to or less than $250.

- A Stop-limit order has both a stop price and a limit price. When the set stop price for this pair is reached, the order is activated and executed as a normal limit order.

- A Stop-market order is an order that is not visible to the market and activates a market order after the stop price is reached.

- A Conditional-limit order places a limit order for the pair selected by the user. To activate it, the price of the guiding pair must reach the specified mark.

- A Conditional-market order works on the same principle as a Conditional-limit, but with one difference. In a Conditional-market, you cannot specify the price for the guiding pair – it is automatically set in accordance with the market price.

We figured out the types and functions of orders. To create an order, go to Basic tradepage and select a trading pair in the Market window. Then select the necessary order and enter the requested data – price, number of assets, and stop price (for stop-orders). Press the Buy/Sell button.

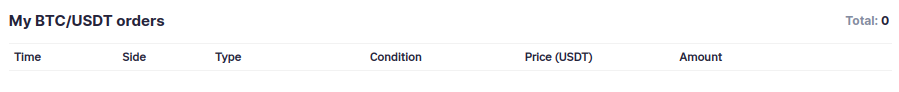

All active trades are displayed in the Orders section.

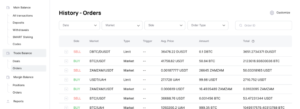

Inactive and completed orders can be seen in the History section, which is located in the Orders tab in the upper right part of the screen.

That’s all! We hope this article was helpful for you and helped you understand the basic trading principle on WhiteBIT. We wish you successful transactions!